In a world increasingly defined by volatility and uncertainty, the concept of “classic insurance” might seem like a relic of a bygone era. But beneath the veneer of digital disruption and innovative insurance models lies a timeless foundation of risk management and financial security that remains as relevant as ever. Classic insurance, with its roots in centuries-old principles, provides a framework for navigating life’s unexpected turns, offering individuals and businesses a safety net against unforeseen circumstances.

This article delves into the core principles of classic insurance, exploring its historical context, its various types, and its enduring value in today’s world. We’ll examine the benefits and limitations of this traditional approach, comparing it to modern insurance models and considering its potential future in an evolving landscape.

What is Classic Insurance?

Classic insurance, also known as traditional insurance, represents a foundational model of risk management that has been practiced for centuries. It involves a contractual agreement between an insurer and an insured, where the insurer promises to compensate the insured for financial losses arising from specific events, in exchange for regular premium payments.

Key Characteristics of Classic Insurance

Classic insurance is characterized by several defining features that differentiate it from other risk management approaches.

- Premium Payments: Policyholders pay regular premiums to the insurer, creating a pool of funds that will be used to cover potential claims.

- Risk Transfer: The insured transfers the financial risk of a specific event to the insurer, who assumes responsibility for covering the losses.

- Contractual Agreement: The relationship between the insurer and the insured is governed by a legally binding contract, outlining the terms and conditions of coverage.

- Indemnity Principle: Classic insurance operates on the principle of indemnity, meaning the insured is compensated for the actual financial loss incurred, but not more.

Historical Context and Evolution of Classic Insurance

The roots of classic insurance can be traced back to ancient civilizations, where groups of individuals would pool their resources to compensate members for losses caused by unforeseen events like fire or theft.

- Early Forms of Insurance: In ancient Babylon, merchants would share the risk of losing their goods at sea by contributing to a common fund. This practice evolved into the concept of marine insurance, which later expanded to cover other risks.

- Emergence of Modern Insurance: The development of modern insurance can be attributed to the rise of maritime trade in the 14th century, as well as the growth of urban centers and the associated need for fire insurance.

- Expansion and Specialization: Over time, insurance evolved to cover a wider range of risks, including life, health, property, and liability. The industry also became increasingly specialized, with different companies focusing on specific types of insurance.

Core Principles and Values of Classic Insurance

Classic insurance is founded on several fundamental principles that underpin its operations and value proposition.

- Risk Pooling: The core principle of classic insurance is risk pooling, where a large number of individuals contribute to a common fund to cover the potential losses of a few.

- Predictability: By leveraging statistical data and actuarial science, insurers can estimate the probability of future events and price premiums accordingly.

- Fairness and Equity: Classic insurance aims to ensure that premiums are fairly assessed and that claims are settled equitably, based on the terms of the policy.

- Financial Stability: The financial stability of insurers is crucial to ensure they can meet their obligations to policyholders. This is achieved through prudent investment strategies and regulatory oversight.

Types of Classic Insurance

Classic insurance policies are designed to protect individuals and businesses from financial losses arising from unforeseen events. These policies fall into various categories, each offering specific coverage and benefits.

Life Insurance

Life insurance provides financial protection to beneficiaries upon the insured’s death. It is crucial for families who rely on the deceased’s income or for covering funeral expenses and outstanding debts. There are two main types of life insurance:

- Term life insurance provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance but does not build cash value.

- Permanent life insurance provides lifelong coverage and accumulates cash value that can be borrowed against or withdrawn. Examples include whole life insurance, universal life insurance, and variable life insurance.

Property Insurance

Property insurance protects individuals and businesses from financial losses due to damage or destruction of their property. This type of insurance covers a wide range of assets, including homes, buildings, vehicles, and personal belongings.

- Homeowners insurance provides coverage for damage to the insured’s home and personal property due to perils like fire, theft, and natural disasters.

- Renters insurance protects tenants’ personal belongings against damage or loss, as well as providing liability coverage.

- Commercial property insurance covers businesses’ buildings, equipment, and inventory against various risks.

Liability Insurance

Liability insurance safeguards individuals and businesses against financial losses arising from legal claims due to negligence or other incidents causing harm to others. This coverage protects against lawsuits and legal expenses associated with accidents, injuries, and property damage.

- Auto insurance provides coverage for damages caused by accidents, including bodily injury and property damage liability.

- General liability insurance protects businesses from claims arising from accidents on their premises, faulty products, or services.

- Professional liability insurance, also known as errors and omissions insurance, protects professionals like doctors, lawyers, and accountants against claims related to their services.

Health Insurance

Health insurance helps individuals and families pay for medical expenses, including doctor visits, hospital stays, and prescription drugs. This coverage protects against the high costs associated with illness, injury, and unexpected medical events.

- Individual health insurance is purchased directly by individuals and provides coverage for their own medical expenses.

- Group health insurance is offered by employers to their employees, providing coverage to a larger group of individuals.

- Medicare is a government-funded health insurance program for individuals aged 65 and older, as well as those with certain disabilities.

- Medicaid is a government-funded health insurance program for low-income individuals and families.

Other Classic Insurance Types

In addition to the main categories, there are various other types of classic insurance policies available, including:

- Disability insurance provides income replacement if the insured becomes unable to work due to illness or injury.

- Long-term care insurance helps cover the costs of long-term care services, such as nursing home care or assisted living.

- Travel insurance provides coverage for unexpected events during travel, such as medical emergencies, flight cancellations, and lost luggage.

- Pet insurance covers veterinary expenses for pets in case of illness or injury.

Key Features of Classic Insurance

Classic insurance, a cornerstone of risk management, operates on fundamental principles that govern its structure and function. These principles define the relationship between the insurer and the insured, outlining the terms of coverage, payment obligations, and dispute resolution.

Premiums

Premiums represent the financial foundation of classic insurance. They are the regular payments made by the insured to the insurer in exchange for coverage against specific risks. Premium calculation is a complex process that involves actuarial science, statistical analysis, and risk assessment.

Premiums are determined by the insurer based on factors such as the type of coverage, the insured’s risk profile, and the likelihood of claims.

Coverage

Coverage refers to the specific risks and events that are protected under an insurance policy. Policies can cover a wide range of risks, including property damage, personal injury, liability, and financial losses. The extent of coverage is defined by the policy terms and conditions.

Deductibles

Deductibles are the predetermined amounts that the insured is responsible for paying out of pocket before the insurer begins to cover the remaining costs of a claim. Deductibles are a common feature of classic insurance policies, designed to reduce the frequency of small claims and encourage policyholders to take precautions against losses.

Claims Processes

The claims process refers to the procedures involved in filing and processing insurance claims. When an insured experiences a covered event, they must file a claim with the insurer. The insurer will then investigate the claim, verify the validity of the claim, and determine the amount of coverage owed.

Actuarial Science in Classic Insurance

Actuarial science plays a crucial role in classic insurance by providing the foundation for pricing and risk assessment. Actuaries use statistical models and data analysis to predict future claims and determine appropriate premium rates.

Actuarial science helps insurers to balance the risk of insuring a large number of individuals with the need to maintain financial stability.

Legal and Regulatory Framework

Classic insurance operates within a complex legal and regulatory framework that ensures fairness, transparency, and consumer protection. Insurance companies are subject to licensing requirements, regulatory oversight, and legal constraints.

Regulatory bodies, such as state insurance departments, play a vital role in monitoring the financial solvency of insurance companies and protecting policyholders from unfair practices.

Benefits of Classic Insurance

Classic insurance, with its traditional approach to risk management, offers a wide range of benefits for individuals and businesses alike. It provides financial security and peace of mind by offering protection against unforeseen events, ultimately helping individuals and businesses navigate uncertain times with greater confidence.

Financial Security and Peace of Mind

Classic insurance plays a crucial role in providing financial security and peace of mind. It acts as a safety net, offering financial support during challenging times. By transferring the risk of potential financial losses to the insurance provider, individuals and businesses can protect their assets and financial well-being.

- Protection against unforeseen events: Classic insurance policies are designed to cover a wide range of risks, including accidents, illnesses, natural disasters, and other unexpected events. This protection ensures that individuals and businesses have the financial resources to recover from such events and minimize the impact on their lives and operations. For example, in the event of a car accident, a comprehensive auto insurance policy can cover repair costs, medical expenses, and lost wages, providing much-needed financial support during a difficult time.

- Financial stability and security: By providing financial compensation for covered losses, classic insurance policies help individuals and businesses maintain financial stability and security. This peace of mind allows them to focus on other aspects of their lives and businesses without the constant worry of unexpected financial burdens.

- Peace of mind and stress reduction: Knowing that they have insurance coverage in place, individuals and businesses can enjoy greater peace of mind and reduce stress levels. This peace of mind allows them to focus on their goals and aspirations without the constant fear of financial hardship.

Risk Management and Loss Mitigation

Classic insurance plays a vital role in risk management and loss mitigation by providing a framework for managing and minimizing potential losses. It allows individuals and businesses to transfer the risk of financial losses to the insurance provider, effectively reducing their exposure to unforeseen events.

- Risk transfer and mitigation: By purchasing an insurance policy, individuals and businesses transfer the risk of potential financial losses to the insurance provider. This transfer of risk helps them reduce their financial exposure and mitigate the potential impact of unforeseen events. For example, a business owner can purchase property insurance to protect their business assets from damage caused by fire, theft, or natural disasters. This policy will cover the costs of repairing or replacing the damaged assets, minimizing the financial impact on the business.

- Financial planning and stability: Classic insurance policies provide a framework for financial planning and stability. By incorporating insurance premiums into their budgets, individuals and businesses can plan for potential financial risks and ensure that they have the resources to manage them effectively. This proactive approach to risk management helps them maintain financial stability and avoid unforeseen financial hardship.

- Business continuity and operational resilience: Classic insurance policies can play a crucial role in ensuring business continuity and operational resilience. By providing financial support in the event of a covered loss, insurance policies help businesses recover from disruptions and continue their operations. For example, a business interruption insurance policy can provide financial compensation for lost revenue during a period of closure due to a covered event, allowing the business to resume operations quickly and minimize the impact on its profitability.

Limitations of Classic Insurance

Classic insurance, despite its long-standing presence and familiarity, faces several limitations in the modern context. While it offers valuable protection, its traditional structure can struggle to adapt to the rapidly evolving needs and complexities of today’s world.

The Inflexibility of Classic Insurance

Classic insurance models are often rigid and inflexible, making it difficult to tailor coverage to individual needs and circumstances. The standardized policies and fixed premiums can result in a mismatch between the coverage provided and the actual risks faced by policyholders. For example, a young, healthy individual may be paying for a comprehensive health insurance plan that includes coverage for chronic conditions they are unlikely to develop.

The Challenge of Data Utilization

Classic insurance relies heavily on actuarial data and historical trends to determine premiums and coverage. However, the vast amounts of data available today, including real-time health data, lifestyle information, and emerging risk factors, are not fully leveraged by traditional models. This limits the ability to personalize premiums and provide more accurate risk assessments.

The Rise of New Risks

The modern world is characterized by emerging risks that are not adequately addressed by classic insurance. Cyberattacks, data breaches, and environmental disasters are examples of evolving threats that require innovative insurance solutions. Traditional insurance models may struggle to keep pace with these new risks and provide adequate coverage.

The Increasing Demand for Customization

Consumers are increasingly demanding personalized insurance solutions that cater to their specific needs and preferences. Classic insurance, with its standardized policies, may not be able to meet this growing demand for customized coverage. The need for flexible, modular insurance products that can be tailored to individual risk profiles is becoming more apparent.

Classic Insurance in the Modern World

The insurance landscape is undergoing a rapid transformation driven by technological advancements and evolving consumer preferences. While classic insurance models have long served as the bedrock of risk management, they are now facing new challenges and opportunities in the digital age. This section examines how technology is reshaping the industry and explores the potential for classic insurance to adapt and thrive in a changing world.

The Impact of Technological Advancements

Technological advancements are profoundly impacting classic insurance in several ways:

- Data Analytics: The availability of vast amounts of data from various sources, including social media, wearables, and connected devices, is enabling insurers to better assess risk, personalize pricing, and develop innovative products. This data-driven approach is allowing for more accurate risk assessments, leading to more tailored insurance policies and potentially lower premiums for policyholders.

- Artificial Intelligence (AI): AI algorithms are being used to automate tasks, streamline processes, and improve customer service. For example, chatbots can handle basic inquiries and claims, freeing up human agents to focus on more complex issues. AI-powered fraud detection systems are also helping insurers to identify and prevent fraudulent claims.

- Internet of Things (IoT): The proliferation of connected devices is providing insurers with real-time data on policyholders’ behaviors and environments. This data can be used to assess risk, provide personalized recommendations, and even intervene to prevent accidents. For example, telematics devices in cars can track driving habits and provide feedback to drivers, leading to safer driving and potentially lower premiums.

Rise of Digital Insurance Platforms

The rise of digital insurance platforms, often referred to as InsurTech, is disrupting the traditional insurance industry. These platforms leverage technology to offer more convenient, transparent, and affordable insurance products:

- Direct-to-Consumer Sales: Digital platforms bypass traditional intermediaries, allowing insurers to sell directly to consumers, often at lower prices. This direct-to-consumer approach is making insurance more accessible and convenient for consumers.

- Personalized Products: Digital platforms use data analytics to tailor insurance products to individual needs and preferences. This personalized approach allows consumers to purchase only the coverage they need, potentially reducing costs and increasing satisfaction.

- Enhanced Customer Experience: Digital platforms provide a seamless and convenient customer experience, with online quoting, policy management, and claims processing. These platforms also offer 24/7 access to customer support, improving responsiveness and satisfaction.

Adapting and Evolving

Classic insurance companies face a crucial decision: adapt to the changing landscape or risk falling behind. Many insurers are embracing digital technologies and innovating to remain competitive:

- Digital Transformation: Traditional insurers are investing in digital technologies to improve their operations, customer service, and product offerings. This includes adopting cloud computing, AI, and data analytics to streamline processes and enhance customer experiences.

- Partnerships with InsurTechs: Many insurers are collaborating with InsurTech startups to gain access to cutting-edge technologies and innovative solutions. These partnerships allow traditional insurers to leverage the agility and innovation of InsurTech companies while retaining their expertise and brand recognition.

- Developing New Products: Insurers are developing new products and services tailored to the needs of digital consumers. This includes products that leverage data analytics, AI, and IoT to provide personalized coverage and risk management solutions.

Classic Insurance vs. Modern Insurance

The insurance industry, while steeped in tradition, is undergoing a dramatic transformation. This evolution has led to a clear distinction between the classic insurance approach and the modern, more tech-driven model. This section explores the differences, advantages, and disadvantages of each approach, and examines the potential for hybrid models.

Classic Insurance Approach

Classic insurance models are characterized by their reliance on traditional practices and established processes. These models often involve:

* Manual Underwriting: Relying on human experts to assess risk and determine premiums.

* Paper-Based Processes: Using physical documents for policy administration and claims processing.

* Limited Data Utilization: Using historical data and basic actuarial models for risk assessment.

* Siloed Operations: Separate departments handling underwriting, claims, and customer service.

* Limited Customer Engagement: Primarily focusing on providing coverage and processing claims.

Modern Insurance Approach

Modern insurance models leverage technological advancements to enhance efficiency, customer experience, and risk assessment. These models often involve:

* Data-Driven Underwriting: Utilizing advanced algorithms and big data analytics to assess risk.

* Digital Processes: Automating policy administration, claims processing, and customer interactions.

* Real-Time Risk Monitoring: Continuously tracking and analyzing risk factors using sensor data and other sources.

* Personalized Customer Experiences: Providing customized insurance products and services based on individual needs.

* Integrated Operations: Connecting different departments through shared data and technology.

Advantages and Disadvantages of Classic and Modern Insurance Approaches

- Classic Insurance Advantages:

* Proven Track Record: Established models with a history of reliability and stability.

* Human Expertise: Skilled underwriters with deep knowledge of specific industries and risks.

* Strong Relationships: Long-standing relationships with clients and brokers. - Classic Insurance Disadvantages:

* Slow Processes: Manual processes can lead to delays in policy issuance and claims processing.

* Limited Flexibility: Traditional models may struggle to adapt to changing market dynamics.

* High Costs: Manual processes and limited automation can result in higher operational costs. - Modern Insurance Advantages:

* Faster and Efficient Processes: Digital processes streamline operations, reducing processing time and costs.

* Improved Risk Assessment: Data-driven models provide more accurate and comprehensive risk assessments.

* Enhanced Customer Experience: Digital platforms offer personalized services and real-time information. - Modern Insurance Disadvantages:

* Initial Investment: Implementing new technologies can require significant upfront investment.

* Data Security Concerns: Protecting sensitive customer data is crucial in digital environments.

* Potential for Bias: Data-driven models may inadvertently perpetuate existing biases.

Hybrid Insurance Models

Hybrid insurance models combine elements of both classic and modern approaches to leverage the strengths of each. These models can:

* Utilize data analytics for risk assessment while retaining human expertise for complex cases.

* Automate routine processes while allowing for human intervention for exceptions and special circumstances.

* Offer personalized customer experiences while maintaining traditional values of trust and reliability.

Hybrid models offer a balanced approach that can address the limitations of both classic and modern insurance models. They provide the efficiency and innovation of modern technologies while preserving the human element and industry expertise that have been hallmarks of classic insurance.

Future of Classic Insurance

The future of classic insurance is intertwined with the evolving landscape of risk and the changing needs of individuals and businesses. As the world becomes increasingly complex and interconnected, traditional approaches to risk management are being challenged, and classic insurance must adapt to remain relevant.

Role of Classic Insurance in a World of Increasing Complexity and Uncertainty

The increasing complexity and uncertainty of the modern world present both opportunities and challenges for classic insurance. On the one hand, the emergence of new risks, such as cyberattacks and climate change, creates a growing demand for insurance products that can mitigate these threats. On the other hand, the interconnectedness of global markets and the increasing frequency of catastrophic events make it more difficult for insurers to assess and price risk accurately.

Potential for Classic Insurance to Remain Relevant and Valuable in the Future

Despite the challenges, classic insurance has the potential to remain relevant and valuable in the future. To achieve this, insurers must embrace innovation and adapt their products and services to meet the evolving needs of their customers. This will involve:

- Developing new products and services to address emerging risks, such as cyberattacks, climate change, and pandemics. Examples include cyber liability insurance, parametric insurance for weather-related events, and pandemic business interruption insurance.

- Leveraging technology to improve efficiency, automate processes, and enhance customer experience. Examples include using artificial intelligence (AI) to assess risk, blockchain to streamline claims processing, and data analytics to personalize insurance products.

- Building strategic partnerships with other industries to expand their reach and offer more comprehensive solutions. Examples include partnering with technology companies to develop innovative insurance products, collaborating with healthcare providers to offer integrated health and insurance solutions, and working with governments to develop public-private partnerships for risk management.

Adapting to Changing Customer Needs

As the needs of individuals and businesses evolve, classic insurance must adapt to remain relevant. This will involve:

- Offering personalized insurance solutions tailored to the specific needs of individual customers. This can be achieved through data analytics, which can be used to identify customer preferences and risk profiles.

- Providing a seamless and convenient customer experience through digital channels, such as mobile apps and online portals. This will allow customers to manage their insurance policies, file claims, and communicate with insurers easily.

- Focusing on customer education to increase awareness of insurance products and services and to help customers make informed decisions. This can be achieved through online resources, educational workshops, and social media campaigns.

Importance of Risk Management

In a world of increasing complexity and uncertainty, effective risk management is more important than ever. Classic insurance can play a vital role in helping individuals and businesses manage their risks and protect their assets.

“The future of classic insurance lies in its ability to adapt to the changing needs of the market and embrace innovation.”

Case Studies of Classic Insurance

Classic insurance has a long and rich history, with numerous examples demonstrating its impact on individuals, businesses, and societies. This section delves into real-world case studies showcasing the benefits and challenges of classic insurance, highlighting its role in addressing specific risks and challenges.

Marine Insurance: The East India Company

Marine insurance played a pivotal role in the success of the East India Company, a powerful trading company that dominated global trade for centuries. The company’s vast network of ships transported valuable goods across oceans, exposing them to numerous risks, including storms, piracy, and shipwrecks. Marine insurance provided crucial financial protection, allowing the company to mitigate losses and continue its operations. The East India Company’s success illustrates the vital role classic insurance played in enabling ambitious commercial ventures and fostering global trade.

Fire Insurance: The Great Fire of London

The Great Fire of London in 1666, which ravaged the city for four days, highlighted the importance of fire insurance. While the fire caused widespread devastation, those who had fire insurance received compensation, enabling them to rebuild their lives and businesses. This event spurred the growth of the fire insurance industry, demonstrating its crucial role in mitigating financial losses and promoting economic recovery after catastrophic events.

Life Insurance: The Victorian Era

The Victorian era witnessed a surge in the popularity of life insurance, driven by factors like industrialization, urbanization, and the rise of the middle class. Life insurance provided families with financial security in the event of the death of the breadwinner, allowing them to cover expenses, educate their children, and maintain their standard of living. The widespread adoption of life insurance during this period underscores its role in addressing the growing need for financial protection and social stability.

Health Insurance: The Rise of Employer-Sponsored Plans

The emergence of employer-sponsored health insurance plans in the 20th century marked a significant shift in the way health insurance was provided. This model, which became widespread in the United States, provided employees with access to affordable health coverage, often through group plans negotiated by employers. The success of employer-sponsored health insurance demonstrates the potential of classic insurance to address specific needs and provide comprehensive coverage for large groups of individuals.

Impact of Classic Insurance on Society

Classic insurance has profoundly shaped modern society, playing a crucial role in promoting economic stability and social well-being. Its impact extends beyond financial protection, influencing various aspects of life, from individual security to the functioning of entire economies.

Economic Stability and Growth

Classic insurance contributes significantly to economic stability by providing financial security against unforeseen events. It mitigates risks for individuals and businesses, allowing them to invest and grow with confidence. For example, life insurance policies provide financial support to families in the event of a breadwinner’s death, ensuring their financial stability. Similarly, property insurance protects homeowners and businesses from losses due to natural disasters or accidents, enabling them to rebuild and recover.

Social Well-being and Security

Classic insurance enhances social well-being by providing a safety net for individuals and communities. It fosters a sense of security and reduces anxiety about potential risks. For instance, health insurance ensures access to medical care, promoting better health outcomes and reducing financial burdens on individuals and families. Social insurance programs, such as unemployment insurance, provide temporary financial support during periods of job loss, helping to maintain a stable standard of living and reduce social unrest.

Ethical Considerations

Classic insurance practices raise ethical considerations related to fairness, transparency, and accessibility. Ensuring that insurance products are accessible to all segments of society, regardless of their socioeconomic status, is a critical ethical imperative. Moreover, the industry must strive for transparency in pricing and coverage, preventing unfair or discriminatory practices. Ethical considerations also extend to the responsible investment of insurance premiums, ensuring that funds are used to benefit policyholders and society as a whole.

Resources for Classic Insurance

Finding reliable and comprehensive information about classic insurance can be challenging, especially for individuals seeking to understand its nuances and historical context. Fortunately, several resources are available to assist in navigating this domain.

These resources offer a range of information, from historical perspectives to contemporary applications and practical guidance for obtaining classic insurance policies.

Websites and Organizations

The internet provides a wealth of information on classic insurance, with numerous websites and organizations dedicated to preserving its history and promoting its relevance in the modern world.

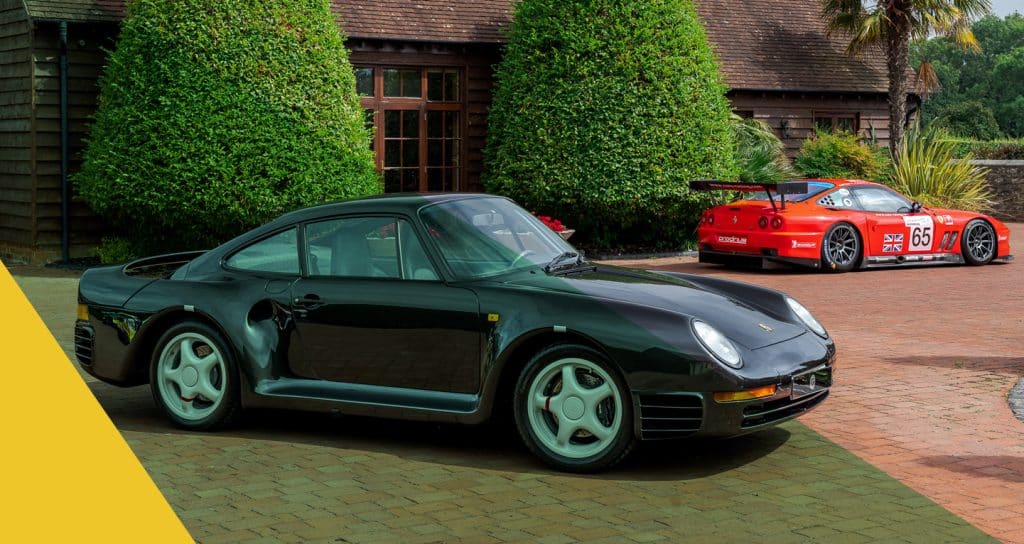

- The Society of Automotive Historians (SAH): A prominent organization dedicated to preserving and sharing the history of automobiles, including the evolution of insurance policies specifically tailored for classic vehicles. The SAH offers resources, publications, and networking opportunities for enthusiasts and professionals interested in classic car insurance.

- The Classic Car Club of America (CCCA): A renowned organization for classic car enthusiasts, the CCCA provides resources on classic insurance, including information on finding qualified insurance professionals and obtaining advice on specific policies.

- The Antique Automobile Club of America (AACA): A respected organization for antique car enthusiasts, the AACA offers guidance on classic insurance, including resources on finding reputable insurers and understanding the intricacies of classic car policies.

- The Hagerty Insurance Agency: A leading provider of classic car insurance, Hagerty offers a comprehensive website with information on various aspects of classic insurance, including policy types, coverage options, and historical perspectives.

- The American Automobile Association (AAA): A well-established organization providing various services, including insurance. AAA offers specialized insurance policies for classic vehicles, with dedicated resources for understanding the nuances of classic car coverage.

Publications

Publications play a vital role in disseminating knowledge and insights on classic insurance, providing in-depth analysis, historical perspectives, and practical guidance.

- Classic Car magazine: A leading publication dedicated to classic cars, Classic Car magazine regularly features articles on classic insurance, covering topics such as policy options, coverage considerations, and historical trends.

- Hemmings Motor News: A prominent publication for classic car enthusiasts, Hemmings Motor News provides valuable information on classic insurance, including articles on finding qualified insurance professionals and navigating the intricacies of classic car policies.

- The Automobile Quarterly: A prestigious publication dedicated to the history of automobiles, The Automobile Quarterly features articles on classic insurance, offering historical perspectives and in-depth analyses of the evolution of classic car policies.

Finding Qualified Insurance Professionals

Identifying a qualified insurance professional specializing in classic insurance is crucial for obtaining the appropriate coverage for your vehicle.

- Professional organizations: Joining organizations like the SAH, CCCA, or AACA can connect you with professionals who understand the unique requirements of classic car insurance.

- Online directories: Websites like the National Association of Insurance Commissioners (NAIC) provide directories of licensed insurance professionals, allowing you to search for specialists in classic car insurance.

- Word-of-mouth referrals: Seeking recommendations from fellow classic car enthusiasts or trusted advisors can lead you to reputable insurance professionals specializing in classic insurance.

Epilogue

While the insurance landscape continues to evolve, the core principles of classic insurance remain fundamental. Its emphasis on risk assessment, actuarial science, and the creation of a financial safety net continues to provide a solid foundation for individuals and businesses seeking to mitigate risk and secure their financial future. As technology reshapes the industry, classic insurance stands as a testament to the enduring value of established principles, reminding us that the need for financial protection remains a timeless human concern.