In the Lone Star State, navigating the complex world of car insurance can feel like traversing a vast, dusty landscape. Understanding the nuances of full coverage car insurance in Texas is essential for drivers seeking comprehensive protection. This guide delves into the intricacies of full coverage policies, exploring the key components, influencing factors, and crucial considerations for Texas residents.

From defining the essential elements of full coverage to analyzing the impact of driving history, vehicle type, and location on premiums, this comprehensive resource equips Texans with the knowledge needed to make informed decisions about their car insurance. We’ll examine the diverse landscape of insurance providers, offering insights into choosing the right provider for your needs. This guide will also explore the role of deductibles, coverage limits, and insurance agents in ensuring optimal coverage and minimizing costs.

Understanding Full Coverage Car Insurance in Texas

Full coverage car insurance in Texas is a comprehensive package that protects you financially against various risks associated with owning and operating a vehicle. This type of insurance goes beyond the minimum requirements mandated by the state, offering more extensive coverage and peace of mind.

Mandatory Insurance Requirements in Texas

Texas law requires all drivers to carry at least the following types of insurance:

- Liability Coverage: This protects you financially if you cause an accident that injures another person or damages their property. It includes bodily injury liability and property damage liability coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It covers medical expenses, lost wages, and property damage.

While these are the minimum requirements, opting for full coverage provides more comprehensive protection.

Types of Coverage Included in Full Coverage Policies

Full coverage car insurance in Texas typically includes the following types of coverage in addition to the mandatory requirements:

- Collision Coverage: This pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It covers damage caused by another vehicle, a stationary object, or even a single-car accident.

- Comprehensive Coverage: This protects your vehicle from damage caused by non-collision events such as theft, vandalism, fire, hail, or natural disasters. It covers damage to your vehicle, even if it is not involved in an accident.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of fault, in the event of an accident. It covers medical bills, lost wages, and other related expenses.

- Personal Injury Protection (PIP): This coverage is similar to Med Pay but often includes broader coverage for medical expenses and lost wages. It may also cover other expenses like funeral costs or childcare.

Full coverage policies often include other optional coverage, such as:

- Rental Car Coverage: This covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This provides assistance in case of breakdowns, flat tires, or other roadside emergencies.

- Gap Insurance: This covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled.

Factors Influencing Full Coverage Premiums in Texas

Full coverage car insurance in Texas encompasses both liability and comprehensive coverage, protecting you from financial burdens arising from accidents, theft, and natural disasters. The cost of this coverage is determined by several factors, each playing a significant role in shaping your premium.

Driving History

Your driving history is a crucial factor in determining your full coverage insurance premiums. Insurance companies assess your driving record to gauge your risk profile. A clean driving record with no accidents or violations typically translates into lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums.

For instance, a driver with multiple speeding tickets and a recent accident may face significantly higher premiums compared to a driver with a spotless record.

Age

Age is another important factor influencing your insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk profile generally results in higher premiums for young drivers.

As drivers gain experience and mature, their risk profile decreases, leading to lower premiums with age.

Vehicle Type

The type of vehicle you drive also significantly impacts your insurance premiums. High-performance vehicles, luxury cars, and vehicles with a history of theft or accidents tend to have higher insurance premiums due to their increased risk of damage or loss.

For example, a sports car will typically have a higher premium compared to a standard sedan due to its higher repair costs and potential for higher speeds.

Credit Score

In Texas, insurance companies are allowed to use your credit score as a factor in determining your insurance premiums. This practice is based on the theory that individuals with good credit history are more financially responsible and less likely to file fraudulent claims.

A higher credit score generally leads to lower premiums, while a lower credit score may result in higher premiums.

Location

The location where you live can also impact your full coverage insurance premiums. Areas with higher crime rates, denser populations, and more frequent accidents tend to have higher insurance premiums.

For example, drivers residing in major metropolitan areas with congested traffic and higher crime rates may face higher premiums compared to drivers in rural areas.

Choosing the Right Full Coverage Provider in Texas

Navigating the diverse landscape of car insurance providers in Texas can be a daunting task. To find the best full coverage policy, it’s crucial to compare different insurers based on their reputation, financial stability, and customer service.

Comparing Car Insurance Providers in Texas

To effectively compare car insurance providers, consider factors like coverage options, pricing, customer reviews, and claims handling processes.

- State Farm: Known for its strong financial stability and extensive network of agents, State Farm offers a wide range of coverage options and competitive rates. They also boast a high customer satisfaction rating.

- Progressive: Progressive is renowned for its innovative technology, including its popular Name Your Price tool that allows customers to set their desired premium and find policies that match. They offer a variety of discounts and have a strong online presence.

- Geico: Geico is known for its affordable rates and easy-to-use online platform. They have a large customer base and offer a wide range of discounts, including those for good driving records and bundling multiple policies.

- USAA: USAA is a highly-rated insurer that specializes in serving active military personnel, veterans, and their families. They offer competitive rates, excellent customer service, and a strong financial foundation.

- Allstate: Allstate offers a wide range of coverage options and has a strong reputation for its claims handling process. They provide various discounts and have a significant presence in Texas.

Analyzing Provider Reputation, Financial Stability, and Customer Service

Understanding the reputation, financial stability, and customer service of major insurers is crucial for making an informed decision.

- Reputation: A strong reputation is a key indicator of a provider’s reliability and trustworthiness. Research online reviews, industry ratings, and customer feedback to assess a company’s reputation for fair pricing, prompt claims handling, and overall customer satisfaction.

- Financial Stability: Financial stability ensures that an insurer can fulfill its obligations in the event of a claim. Look for companies with high credit ratings and a history of financial strength.

- Customer Service: Excellent customer service is vital for a positive insurance experience. Consider factors like responsiveness, accessibility, and the overall ease of communication with the insurer.

Finding Competitive Quotes and Securing the Best Value

Obtaining competitive quotes from multiple insurers is essential for finding the best value.

- Compare Quotes Online: Utilize online comparison tools to quickly and easily compare quotes from different insurers. These tools allow you to input your specific details and receive personalized quotes.

- Contact Insurers Directly: Reach out to insurers directly to discuss your needs and obtain customized quotes. This allows for a more in-depth conversation and potential negotiation of terms.

- Consider Discounts: Inquire about available discounts, such as those for good driving records, safe driving courses, bundling multiple policies, and installing safety features in your vehicle.

- Review Policy Details: Thoroughly review the policy details, including coverage limits, deductibles, and exclusions, to ensure that the chosen policy meets your specific requirements.

Key Considerations for Full Coverage Policyholders in Texas

Navigating the intricacies of full coverage car insurance in Texas necessitates a comprehensive understanding of the policy’s terms and conditions, the claims process, and strategies for cost optimization. This section delves into these crucial aspects, empowering policyholders to make informed decisions and maximize their coverage benefits.

Understanding Policy Terms and Conditions

The foundation of a successful insurance experience lies in a thorough comprehension of the policy’s terms and conditions. These documents Artikel the scope of coverage, exclusions, and responsibilities of both the insurer and the policyholder.

- Coverage Limits: Policyholders should carefully review the coverage limits for various aspects, such as liability, collision, comprehensive, and medical payments. These limits determine the maximum amount the insurer will pay for covered losses.

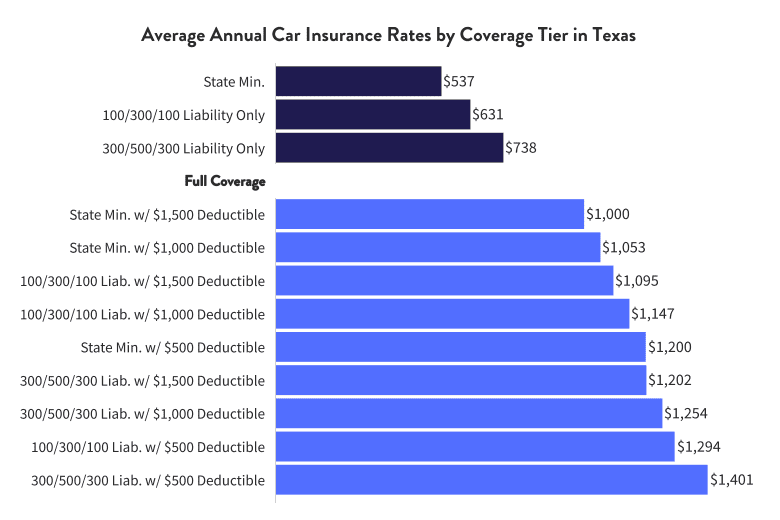

- Deductibles: The deductible is the amount a policyholder pays out-of-pocket before the insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

- Exclusions: Policies often contain exclusions, which are specific events or circumstances not covered by the insurance. Policyholders should familiarize themselves with these exclusions to avoid unexpected costs.

- Policy Period: The policy period defines the duration of coverage. Policyholders should ensure they understand the renewal process and the implications of non-renewal.

Filing a Claim and Navigating Insurance Procedures

When an insured event occurs, policyholders must promptly notify their insurer and follow the prescribed claim filing procedures. This section provides insights into the claim process and navigating insurance procedures.

- Prompt Notification: Immediately contact the insurer after an accident or other covered event. Delaying notification can jeopardize coverage.

- Gather Information: Collect all relevant information, including the date, time, location of the incident, and details of any involved parties. Take photos of the damage and obtain contact information from witnesses.

- Follow Instructions: The insurer will provide specific instructions on how to file a claim. Adhere to these instructions diligently to avoid delays or complications.

- Documentation: Maintain detailed records of all communications with the insurer, including claim numbers, dates, and the names of individuals involved.

Minimizing Insurance Costs and Maximizing Coverage Benefits

Insurance costs can be significant, but policyholders can take proactive steps to minimize premiums and optimize their coverage benefits. This section explores strategies for cost reduction and coverage enhancement.

- Maintain a Good Driving Record: Avoiding traffic violations and accidents can significantly lower premiums.

- Consider Discounts: Many insurers offer discounts for various factors, such as good student status, safe driving courses, and multiple vehicle insurance.

- Shop Around for Quotes: Compare quotes from multiple insurers to find the most competitive rates.

- Increase Deductible: Raising the deductible can lower premiums but will result in higher out-of-pocket expenses in case of a claim.

- Review Coverage Needs: Periodically review coverage needs to ensure they align with current circumstances and financial capabilities.

Understanding Deductibles and Coverage Limits

Full coverage car insurance in Texas, while comprehensive, comes with two crucial elements that directly impact your out-of-pocket expenses in case of an accident: deductibles and coverage limits. Understanding these concepts is essential for making informed decisions about your policy and ensuring you have adequate financial protection.

Deductibles

The deductible is the amount you agree to pay out-of-pocket before your insurance company starts covering the costs of repairs or replacement after an accident. Higher deductibles typically lead to lower premiums, while lower deductibles result in higher premiums.

Choosing an appropriate deductible involves a careful balance between affordability and financial risk. For instance, a high deductible might seem attractive for lower premiums, but you’ll have to shoulder a larger portion of the costs in case of an accident. Conversely, a lower deductible offers more protection but comes with higher premiums.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for specific types of claims. These limits are set for different categories of coverage, such as bodily injury liability, property damage liability, and collision coverage.

Having sufficient coverage limits is crucial to ensure adequate financial protection in case of significant accidents. If your coverage limits are too low, you could face substantial out-of-pocket expenses even after your insurance company has paid its share.

For example, if your bodily injury liability coverage limit is $50,000 per person and you are involved in an accident that causes $100,000 in injuries, you would be personally liable for the remaining $50,000.

Choosing Appropriate Deductibles and Coverage Limits

Selecting the right deductibles and coverage limits requires careful consideration of your individual circumstances and risk tolerance. Factors to consider include:

- Your financial situation: A higher deductible might be suitable if you have a comfortable financial cushion to cover potential out-of-pocket expenses.

- The value of your vehicle: Higher coverage limits are recommended for newer or more expensive vehicles to ensure adequate compensation in case of a total loss.

- Your driving history: Drivers with a clean driving record might be comfortable with higher deductibles, while those with a history of accidents might prefer lower deductibles for greater protection.

- Your personal risk tolerance: Some individuals are more risk-averse and prefer lower deductibles and higher coverage limits, while others are comfortable with higher deductibles and lower premiums.

It’s recommended to consult with an insurance agent to discuss your specific needs and determine the most appropriate deductibles and coverage limits for your full coverage car insurance policy in Texas.

The Role of Insurance Agents and Brokers in Texas

Navigating the complex world of car insurance in Texas can be overwhelming. This is where insurance agents and brokers come in, offering invaluable guidance and support throughout the process.

These professionals act as intermediaries between you and insurance companies, providing personalized advice and helping you find the best coverage at the most competitive price.

Services Offered by Insurance Agents and Brokers

Insurance agents and brokers in Texas offer a wide range of services, tailored to meet your individual needs.

- Needs Assessment: Agents and brokers will carefully assess your individual circumstances, such as your driving history, vehicle type, and budget, to understand your specific insurance needs. They will then recommend coverage options that align with your requirements.

- Policy Comparison: They have access to multiple insurance companies and can compare policies from various providers, helping you find the best value for your money. This saves you time and effort by eliminating the need to contact multiple companies yourself.

- Policy Explanation: Insurance policies can be complex and confusing. Agents and brokers can explain the terms and conditions of your policy in plain language, ensuring you understand your coverage and rights.

- Claims Assistance: In the unfortunate event of an accident, agents and brokers can assist you with the claims process, guiding you through the necessary steps and ensuring your claim is processed smoothly.

- Ongoing Support: They are available to answer any questions you may have about your insurance policy throughout the year, providing ongoing support and guidance.

Benefits of Working with an Agent or Broker

Engaging the services of an insurance agent or broker comes with several benefits that can significantly enhance your car insurance experience.

- Personalized Advice: Agents and brokers take the time to understand your individual needs and provide tailored recommendations, ensuring you get the right coverage at the right price.

- Expert Guidance: They possess in-depth knowledge of the insurance industry and can provide valuable insights into different coverage options, helping you make informed decisions.

- Time Savings: By handling the comparison and selection process for you, agents and brokers save you valuable time and effort. You can focus on other matters while they take care of your insurance needs.

- Negotiation Power: Their relationships with insurance companies often allow them to negotiate better rates and terms on your behalf, potentially saving you money on your premiums.

- Claims Support: In the event of an accident, having an agent or broker by your side can simplify the claims process and ensure your rights are protected.

Finding a Qualified and Trustworthy Insurance Professional

Choosing the right insurance agent or broker is crucial. Here are some tips for finding a qualified and trustworthy professional:

- Seek Recommendations: Ask friends, family, or colleagues for recommendations. Their personal experiences can provide valuable insights into the quality of service provided by different agents and brokers.

- Check Credentials: Ensure the agent or broker is licensed and registered with the Texas Department of Insurance. This verifies their competence and adherence to industry standards.

- Research Online: Look for online reviews and ratings to get a sense of the agent or broker’s reputation and customer satisfaction levels.

- Schedule a Consultation: Meet with a few different agents or brokers to discuss your needs and get a feel for their approach and expertise. This allows you to compare their services and choose the best fit for you.

- Ask Questions: Don’t hesitate to ask questions about their experience, areas of expertise, and fees. A reputable agent or broker will be transparent and willing to answer all your inquiries.

Understanding Coverage Exclusions and Limitations

While full coverage car insurance in Texas offers comprehensive protection, it’s essential to understand that certain events or situations are specifically excluded from coverage. These exclusions are designed to manage risk and ensure the financial sustainability of insurance companies.

Knowing these limitations is crucial for policyholders to avoid unexpected gaps in coverage and make informed decisions about their insurance needs.

Common Exclusions and Limitations

Full coverage policies in Texas typically exclude coverage for the following:

- Wear and Tear: Routine maintenance and deterioration of your vehicle, such as worn tires, brake pads, or a faulty battery, are not covered under full coverage.

- Cosmetic Damage: Scratches, dents, or other minor cosmetic damage that doesn’t affect the vehicle’s functionality are generally not covered.

- Mechanical Failure: Issues arising from a breakdown or malfunction of the vehicle’s mechanical components, such as engine failure, transmission problems, or electrical issues, are not covered.

- Acts of God: While comprehensive coverage includes coverage for certain natural disasters, it may exclude events like earthquakes, floods, or landslides depending on the specific policy and coverage endorsements.

- Civil Unrest: Damage caused by riots, civil commotion, or other forms of public disorder is typically not covered under standard full coverage policies.

- Intentional Acts: Damage caused by intentional acts of the policyholder, such as driving under the influence or vandalism, is excluded from coverage.

- Driving Without a Valid License: If you are driving without a valid driver’s license, your insurance may be voided, leaving you without coverage.

The Impact of Driving Record and Safety Features

Your driving history and the safety features in your vehicle play a significant role in determining your full coverage car insurance premiums in Texas. Insurance companies assess these factors to understand your risk profile and calculate your premium accordingly.

The Influence of Driving Record on Premiums

A clean driving record is essential for obtaining lower insurance premiums. Traffic violations, accidents, and other driving-related incidents can significantly impact your rates. Insurance companies consider the severity and frequency of these incidents when calculating your premium. For example, a speeding ticket or a minor accident could lead to a moderate increase in your premium, while a DUI conviction or a serious accident could result in a substantial premium hike.

- Traffic Violations: Each traffic violation, such as speeding tickets, running red lights, or reckless driving, adds points to your driving record. The more points you accumulate, the higher your insurance premiums will be. Some violations, like DUI convictions, can result in a significant increase in premiums or even the denial of coverage.

- Accidents: Accidents, even those that were not your fault, can negatively impact your insurance premiums. The severity of the accident and your level of fault will determine the impact on your rates. For instance, a minor fender bender may result in a small premium increase, while a serious accident involving injuries or significant property damage could lead to a substantial hike.

- Driving Record History: Insurance companies look at your driving history over a specific period, typically three to five years. A history of frequent violations or accidents will generally result in higher premiums than a clean record.

The Impact of Vehicle Safety Features on Insurance Costs

Modern vehicles are equipped with advanced safety features that can help prevent accidents and mitigate their severity. Insurance companies recognize the benefits of these features and often offer discounts to policyholders who own vehicles with them.

- Anti-lock Braking Systems (ABS): ABS helps prevent wheel lockup during braking, enhancing vehicle control and reducing the risk of accidents. Insurance companies often provide discounts for vehicles equipped with ABS.

- Electronic Stability Control (ESC): ESC helps drivers maintain control of their vehicles during slippery conditions or sudden maneuvers. It can prevent skidding and rollovers, reducing the risk of accidents. Insurance companies often offer discounts for vehicles equipped with ESC.

- Airbags: Airbags are designed to protect occupants during a collision. Vehicles with multiple airbags, including side airbags and curtain airbags, generally qualify for insurance discounts.

- Advanced Driver-Assistance Systems (ADAS): ADAS features, such as lane departure warning, blind spot monitoring, and adaptive cruise control, can help drivers avoid accidents. Insurance companies often offer discounts for vehicles equipped with ADAS features.

The Role of Insurance Regulations and Consumer Protection

In Texas, the insurance industry is heavily regulated to protect consumers and ensure fair practices. The Texas Department of Insurance (TDI) plays a pivotal role in overseeing the industry and advocating for policyholders’ rights.

Texas Insurance Regulations and Consumer Protection Laws

Texas has a comprehensive framework of insurance regulations and consumer protection laws designed to safeguard policyholders. These laws cover various aspects, including:

- Fair and Unfair Trade Practices: These laws prohibit deceptive or unfair insurance practices, such as misrepresenting coverage or refusing to pay legitimate claims.

- Rate Regulation: TDI reviews and approves insurance rates to ensure they are fair and reasonable, preventing excessive pricing.

- Consumer Education: TDI provides extensive resources and information to educate consumers about their rights and responsibilities regarding insurance.

- Complaint Resolution: TDI offers a formal complaint process for resolving disputes between policyholders and insurance companies.

The Role of the Texas Department of Insurance

The TDI is the primary regulatory body for the insurance industry in Texas. Its key responsibilities include:

- Licensing and Oversight: TDI licenses insurance companies and agents, ensuring they meet specific requirements and operate ethically.

- Rate Regulation and Approval: TDI reviews and approves insurance rates to ensure they are fair and reasonable, preventing excessive pricing.

- Consumer Protection: TDI advocates for consumer rights and provides resources to help policyholders understand their coverage and resolve disputes.

- Market Monitoring: TDI monitors the insurance market to identify potential problems and ensure fair competition.

- Enforcement: TDI enforces insurance laws and regulations, taking action against companies or agents that violate the rules.

Resources for Resolving Insurance Disputes or Complaints

Policyholders in Texas have several resources available to resolve disputes or complaints with insurance companies:

- Texas Department of Insurance: TDI provides a formal complaint process for resolving insurance disputes. Consumers can file complaints online, by phone, or by mail.

- Texas Office of the Attorney General: The Attorney General’s Office can investigate insurance fraud and consumer protection violations.

- Mediation: TDI offers a mediation program to help policyholders and insurance companies reach a mutually agreeable resolution.

- Arbitration: If mediation fails, policyholders may choose to resolve their dispute through binding arbitration.

- Litigation: In some cases, policyholders may need to file a lawsuit to resolve their insurance dispute.

Final Thoughts

As you navigate the intricacies of full coverage car insurance in Texas, remember that understanding your policy terms, choosing the right provider, and maintaining a clean driving record are key to maximizing your coverage and minimizing your costs. By embracing the information and insights provided in this guide, you can confidently navigate the Texas car insurance landscape, ensuring you have the protection you need while driving the open roads of the Lone Star State.