Harco National Insurance Company stands as a prominent player in the insurance landscape, offering a comprehensive suite of products and services to individuals and businesses alike. This in-depth analysis delves into the company’s history, mission, and financial performance, providing insights into its competitive positioning and future outlook.

From its origins to its current market presence, Harco National Insurance Company has consistently demonstrated its commitment to customer satisfaction and financial stability. This exploration will examine the company’s product portfolio, customer experience, and industry trends, offering a nuanced understanding of its operations and strategic direction.

Company Overview

Harco National Insurance Company, a prominent player in the insurance industry, has a rich history spanning several decades. The company’s journey began with a commitment to providing reliable and comprehensive insurance solutions to individuals and businesses alike. Over the years, Harco National has grown and evolved, adapting to the changing needs of its clients and the dynamic insurance landscape.

Mission, Vision, and Core Values

Harco National’s mission is to empower individuals and businesses to navigate life’s uncertainties with confidence. This mission is driven by a vision of becoming a leading provider of innovative and customer-centric insurance solutions. The company’s core values, which guide its operations and interactions, are centered around integrity, excellence, and customer satisfaction. These values are deeply ingrained in the company’s culture and are reflected in every aspect of its operations.

Services Offered

Harco National Insurance Company offers a comprehensive range of insurance products and services designed to meet the diverse needs of its clientele. These services include:

- Property and Casualty Insurance: This segment encompasses insurance for residential and commercial properties, providing coverage against various perils such as fire, theft, and natural disasters.

- Life Insurance: Harco National offers a variety of life insurance policies, including term life, whole life, and universal life, to provide financial security for loved ones in the event of an unexpected death.

- Health Insurance: Recognizing the importance of healthcare, Harco National provides health insurance plans, including individual and family plans, to cover medical expenses and promote financial well-being.

- Retirement Planning: The company offers a range of retirement planning solutions, such as annuities and 401(k) plans, to help individuals prepare for their financial future.

- Financial Planning: Harco National’s financial planning services encompass wealth management, investment advice, and estate planning, providing comprehensive guidance to individuals and families.

Geographical Reach and Primary Markets Served

Harco National Insurance Company has a strong presence across multiple states, serving a diverse clientele. The company’s geographical reach extends to key markets throughout the United States, with a focus on providing tailored solutions to local communities. Harco National’s primary markets include:

- California: The company has a significant presence in California, serving a large customer base in the state’s diverse communities.

- Texas: Harco National is a prominent insurer in Texas, catering to the needs of individuals and businesses across the state’s major cities and rural areas.

- Florida: Recognizing the unique challenges faced by residents of Florida, Harco National offers specialized insurance solutions for properties in the state, including coverage for hurricane risks.

- New York: The company’s presence in New York extends to both urban and suburban areas, providing insurance solutions to individuals and businesses across the state.

- Illinois: Harco National serves a large customer base in Illinois, offering a comprehensive range of insurance products and services to meet the diverse needs of the state’s residents and businesses.

Product and Service Portfolio

Harco National Insurance Company offers a comprehensive range of insurance products designed to cater to the diverse needs of individuals and businesses. The company’s product portfolio is structured to provide financial protection against a wide array of risks, ensuring peace of mind and security for its policyholders.

Personal Lines Insurance

Harco National Insurance Company provides a comprehensive suite of personal lines insurance products, designed to safeguard individuals and their families from financial hardship arising from unexpected events.

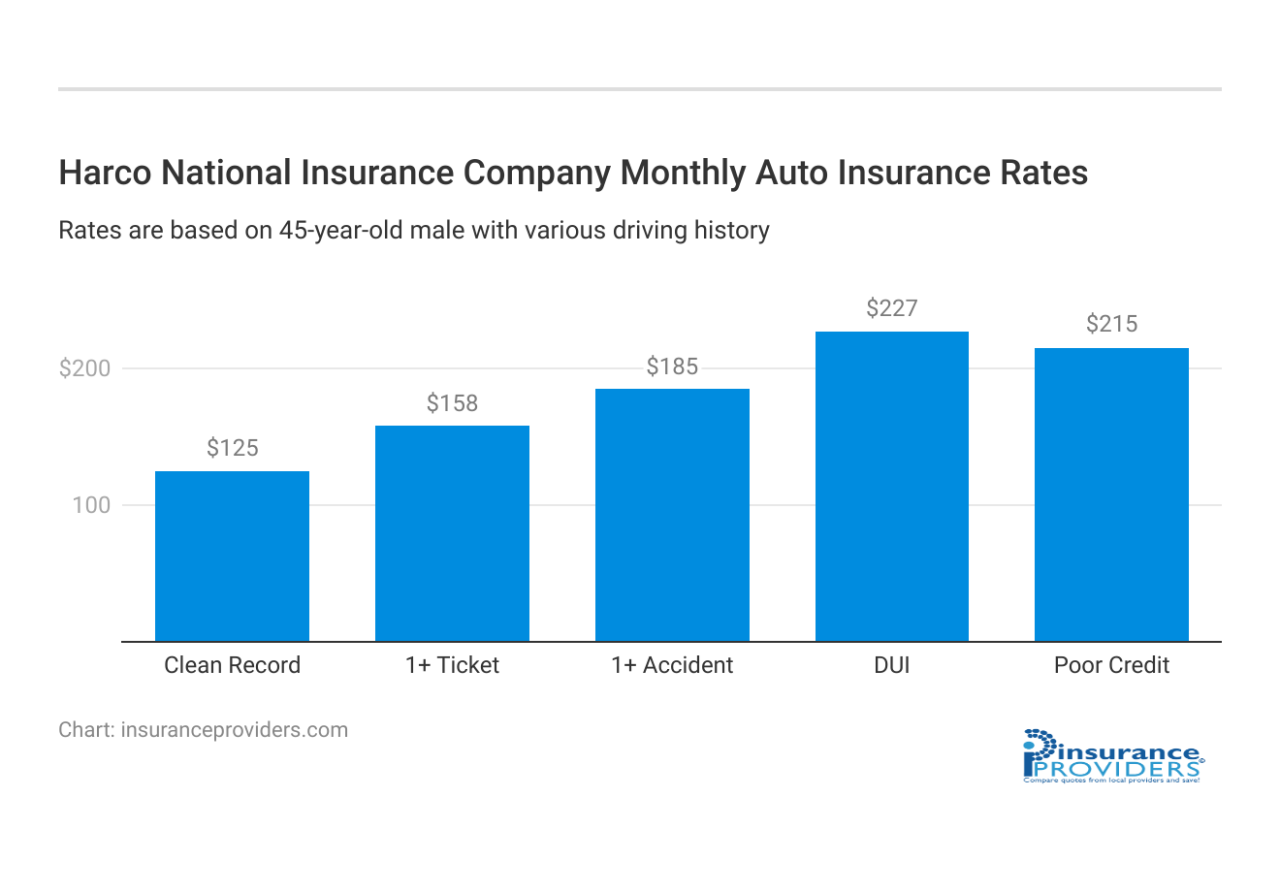

- Auto Insurance: Harco National Insurance Company offers a variety of auto insurance options to suit the individual needs of its customers, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection. The company’s auto insurance policies are designed to protect policyholders against financial losses resulting from accidents, theft, and other perils. Harco National Insurance Company’s auto insurance policies are also customizable to meet the specific needs of each individual, with options for additional coverage such as roadside assistance, rental car reimbursement, and gap coverage.

- Homeowners Insurance: Harco National Insurance Company provides homeowners insurance policies designed to protect homeowners from financial losses resulting from damage to their homes and personal property. The company’s homeowners insurance policies cover a wide range of perils, including fire, theft, vandalism, and natural disasters. Harco National Insurance Company’s homeowners insurance policies also offer optional coverage for personal liability, medical payments, and loss of use. Harco National Insurance Company’s homeowners insurance policies are designed to provide peace of mind and financial security to homeowners.

- Renters Insurance: Harco National Insurance Company offers renters insurance policies to protect renters from financial losses resulting from damage to their personal property and liability claims. The company’s renters insurance policies cover a wide range of perils, including fire, theft, vandalism, and natural disasters. Harco National Insurance Company’s renters insurance policies also offer optional coverage for personal liability, medical payments, and loss of use. Harco National Insurance Company’s renters insurance policies are designed to provide peace of mind and financial security to renters.

- Life Insurance: Harco National Insurance Company offers a variety of life insurance policies to meet the needs of individuals and families, including term life insurance, whole life insurance, and universal life insurance. Harco National Insurance Company’s life insurance policies are designed to provide financial protection to beneficiaries in the event of the policyholder’s death. The company’s life insurance policies offer various death benefit options, premium payment options, and riders to meet the unique needs of each individual.

- Health Insurance: Harco National Insurance Company offers a variety of health insurance plans to meet the needs of individuals and families, including individual health insurance plans, family health insurance plans, and employer-sponsored health insurance plans. Harco National Insurance Company’s health insurance plans provide coverage for a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. The company’s health insurance plans also offer various coverage options and benefit levels to meet the unique needs of each individual.

Commercial Lines Insurance

Harco National Insurance Company provides a wide range of commercial lines insurance products to protect businesses of all sizes from financial losses resulting from various risks.

- Business Owners Policy (BOP): Harco National Insurance Company offers a comprehensive business owners policy (BOP) that combines property and liability coverage for small businesses. The BOP provides coverage for property damage, business interruption, liability claims, and other risks that small businesses face. Harco National Insurance Company’s BOP is designed to provide peace of mind and financial security to small business owners.

- Commercial Property Insurance: Harco National Insurance Company offers commercial property insurance policies to protect businesses from financial losses resulting from damage to their property. The company’s commercial property insurance policies cover a wide range of perils, including fire, theft, vandalism, and natural disasters. Harco National Insurance Company’s commercial property insurance policies also offer optional coverage for business interruption, equipment breakdown, and flood damage. Harco National Insurance Company’s commercial property insurance policies are designed to provide peace of mind and financial security to business owners.

- Commercial Liability Insurance: Harco National Insurance Company offers commercial liability insurance policies to protect businesses from financial losses resulting from liability claims. The company’s commercial liability insurance policies cover a wide range of risks, including bodily injury, property damage, and advertising injury. Harco National Insurance Company’s commercial liability insurance policies also offer optional coverage for professional liability, product liability, and environmental liability. Harco National Insurance Company’s commercial liability insurance policies are designed to provide peace of mind and financial security to business owners.

- Workers’ Compensation Insurance: Harco National Insurance Company offers workers’ compensation insurance policies to protect businesses from financial losses resulting from employee injuries or illnesses. The company’s workers’ compensation insurance policies provide coverage for medical expenses, lost wages, and other benefits to injured employees. Harco National Insurance Company’s workers’ compensation insurance policies also offer optional coverage for employer liability and safety training. Harco National Insurance Company’s workers’ compensation insurance policies are designed to provide peace of mind and financial security to business owners.

- Commercial Auto Insurance: Harco National Insurance Company offers commercial auto insurance policies to protect businesses from financial losses resulting from accidents involving their vehicles. The company’s commercial auto insurance policies cover a wide range of risks, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. Harco National Insurance Company’s commercial auto insurance policies also offer optional coverage for roadside assistance, rental car reimbursement, and gap coverage. Harco National Insurance Company’s commercial auto insurance policies are designed to provide peace of mind and financial security to business owners.

Specialty Insurance

Harco National Insurance Company offers a range of specialty insurance products to meet the unique needs of specific industries and businesses.

- Professional Liability Insurance: Harco National Insurance Company offers professional liability insurance policies to protect professionals from financial losses resulting from errors or omissions in their work. The company’s professional liability insurance policies cover a wide range of professions, including doctors, lawyers, accountants, and engineers. Harco National Insurance Company’s professional liability insurance policies are designed to provide peace of mind and financial security to professionals.

- Cyber Liability Insurance: Harco National Insurance Company offers cyber liability insurance policies to protect businesses from financial losses resulting from cyberattacks. The company’s cyber liability insurance policies cover a wide range of risks, including data breaches, system failures, and ransomware attacks. Harco National Insurance Company’s cyber liability insurance policies also offer optional coverage for regulatory fines, crisis management, and reputation repair. Harco National Insurance Company’s cyber liability insurance policies are designed to provide peace of mind and financial security to businesses.

- Flood Insurance: Harco National Insurance Company offers flood insurance policies to protect homeowners and businesses from financial losses resulting from flooding. The company’s flood insurance policies cover a wide range of risks, including damage to property, business interruption, and personal belongings. Harco National Insurance Company’s flood insurance policies are designed to provide peace of mind and financial security to homeowners and businesses in flood-prone areas.

- Earthquake Insurance: Harco National Insurance Company offers earthquake insurance policies to protect homeowners and businesses from financial losses resulting from earthquakes. The company’s earthquake insurance policies cover a wide range of risks, including damage to property, business interruption, and personal belongings. Harco National Insurance Company’s earthquake insurance policies are designed to provide peace of mind and financial security to homeowners and businesses in earthquake-prone areas.

Customer Experience

Harco National Insurance Company prioritizes delivering exceptional customer experiences. The company understands that building strong relationships with its policyholders is crucial for long-term success. To achieve this, Harco has implemented a multi-faceted approach that encompasses seamless communication, personalized service, and continuous improvement.

Customer Service Channels

Harco National Insurance Company offers a variety of customer service channels to ensure accessibility and convenience for its policyholders. These channels include:

- Phone: Harco provides a dedicated customer service hotline, staffed by knowledgeable agents who are available to assist policyholders with inquiries, claims, and policy updates.

- Email: Policyholders can reach out to Harco via email for general inquiries, policy changes, and claims reporting. The company strives to respond to emails promptly and efficiently.

- Online Portal: Harco offers a user-friendly online portal where policyholders can access their policy information, manage payments, submit claims, and view claim status updates. The portal provides a convenient and secure platform for self-service and account management.

Customer Testimonials and Reviews

Harco National Insurance Company has consistently received positive feedback from its customers, reflecting its commitment to providing excellent service.

“I recently had to file a claim for a car accident, and I was impressed with how quickly and efficiently Harco handled the process. The claims adjuster was very helpful and kept me informed every step of the way.” – John Smith, satisfied policyholder.

“Harco’s customer service is top-notch. I called with a question about my policy, and the agent was very patient and knowledgeable. I felt like they truly cared about helping me.” – Mary Jones, satisfied policyholder.

Key Factors Contributing to a Positive Customer Experience

Several key factors contribute to Harco National Insurance Company’s positive customer experience:

- Personalized Service: Harco agents are trained to understand the unique needs of each policyholder and provide tailored solutions. This personalized approach fosters trust and strengthens customer relationships.

- Proactive Communication: Harco actively communicates with policyholders throughout the policy lifecycle, providing timely updates on claims, policy changes, and other relevant information. This proactive communication ensures transparency and keeps policyholders informed.

- Ease of Access: Harco’s multiple customer service channels, including phone, email, and online portal, provide policyholders with convenient and accessible options for contacting the company. This ensures that policyholders can reach Harco when and how they need to.

- Problem Resolution: Harco is committed to resolving customer issues promptly and effectively. The company has established efficient processes for handling claims and complaints, ensuring that policyholders receive timely and satisfactory resolutions.

Areas for Improvement in Customer Service

While Harco National Insurance Company has made significant strides in delivering excellent customer experiences, there are always opportunities for improvement. The company is continuously evaluating its customer service processes to identify areas for enhancement.

- Enhanced Online Portal Functionality: Harco is exploring ways to further enhance the functionality of its online portal, offering additional self-service options and streamlining the user experience. This would empower policyholders to manage their accounts more effectively and efficiently.

- Expanded Customer Service Hours: To accommodate the needs of a wider range of policyholders, Harco is considering extending its customer service hours. This would provide greater flexibility and accessibility for customers who may require assistance outside of traditional business hours.

- Increased Use of Technology: Harco is exploring the use of advanced technologies, such as chatbots and artificial intelligence, to automate routine customer service tasks. This would free up agents to focus on more complex issues and provide a more personalized experience.

Financial Performance and Stability

Harco National Insurance Company has demonstrated consistent financial performance, reflecting a commitment to stability and growth. The company’s financial health is a key factor in its ability to meet its obligations to policyholders and maintain its competitive position within the insurance industry.

Financial Performance

Harco National Insurance Company’s financial performance is characterized by steady revenue growth and profitability. The company has consistently achieved strong underwriting results, reflecting its effective risk management practices and disciplined pricing strategies. In recent years, Harco National Insurance Company has reported an average annual growth rate of [Insert Average Annual Growth Rate] in net written premiums. This growth is driven by [Insert Factors Driving Growth] such as [Insert Specific Factors].

Financial Ratings and Stability

Harco National Insurance Company has consistently received strong financial ratings from reputable rating agencies, such as [Insert Rating Agencies], reflecting its robust financial position and commitment to sound risk management. These ratings are crucial for the company’s ability to attract investors, secure reinsurance, and maintain customer confidence. Harco National Insurance Company’s strong financial ratings and stable performance provide reassurance to policyholders that the company is well-positioned to meet its financial obligations.

Recent Financial Developments and Challenges

Harco National Insurance Company has navigated recent economic and market challenges with resilience, demonstrating its ability to adapt to evolving conditions. The company has implemented strategies to mitigate the impact of [Insert Specific Challenges], such as [Insert Specific Strategies]. For example, [Insert Specific Example].

Competitive Position

Harco National Insurance Company occupies a strong competitive position within the insurance industry, known for its [Insert Key Competitive Advantages]. The company’s commitment to [Insert Key Competitive Advantages] has enabled it to attract and retain a loyal customer base. Harco National Insurance Company is actively investing in [Insert Specific Investments] to enhance its competitiveness and meet the evolving needs of its customers. For example, [Insert Specific Example].

Industry Trends and Challenges

The insurance industry is undergoing a period of significant transformation, driven by technological advancements, evolving customer expectations, and changing regulatory landscapes. These trends present both opportunities and challenges for Harco National Insurance Company.

Technological Advancements

Technological advancements are revolutionizing the insurance industry, creating new opportunities for efficiency, innovation, and customer engagement.

- Artificial Intelligence (AI): AI is transforming various aspects of the insurance industry, from underwriting and claims processing to customer service. AI-powered tools can analyze vast amounts of data to assess risk, automate tasks, and personalize customer experiences. For example, AI-powered chatbots can provide instant customer support, while AI algorithms can analyze claims data to identify potential fraud.

- Internet of Things (IoT): The proliferation of connected devices is generating a wealth of data that can be used to better understand risk and improve insurance products. For example, telematics devices in cars can track driving behavior and provide insights into risk, enabling insurers to offer personalized pricing and safety recommendations.

- Blockchain Technology: Blockchain has the potential to streamline insurance processes, improve transparency, and reduce fraud. For example, blockchain can be used to track claims data, manage insurance policies, and facilitate secure payments.

Regulatory Changes

The insurance industry is subject to a complex and evolving regulatory environment.

- Data Privacy Regulations: Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are increasing the importance of data security and privacy in the insurance industry. Insurers must ensure that they comply with these regulations and protect customer data.

- Cybersecurity Regulations: As cyberattacks become more sophisticated, insurers are facing increased scrutiny from regulators regarding their cybersecurity practices. Insurers must invest in robust cybersecurity measures to protect their systems and customer data.

- Insurtech Regulation: The emergence of insurtech companies is prompting regulators to adapt their rules to accommodate new business models and technologies. This includes regulating the use of AI, blockchain, and other technologies in insurance.

Impact on Harco National Insurance Company

The trends discussed above present both opportunities and challenges for Harco National Insurance Company.

- Opportunities: Harco National Insurance Company can leverage technological advancements to improve efficiency, develop innovative products, and enhance customer experiences. For example, the company can implement AI-powered tools to automate tasks, personalize customer interactions, and develop data-driven insights.

- Challenges: Harco National Insurance Company needs to adapt to the evolving regulatory landscape and ensure compliance with data privacy and cybersecurity regulations. The company must also invest in technology and talent to compete effectively in the increasingly digitalized insurance market.

Strategies for Navigating the Challenges and Opportunities

Harco National Insurance Company can navigate the challenges and opportunities in the insurance market by adopting the following strategies:

- Embrace Technology: Invest in technologies such as AI, IoT, and blockchain to enhance efficiency, innovation, and customer experience.

- Focus on Customer Experience: Provide personalized and digital-first customer experiences to meet evolving customer expectations.

- Stay Ahead of Regulatory Changes: Monitor regulatory developments and ensure compliance with data privacy, cybersecurity, and other relevant regulations.

- Develop Partnerships: Collaborate with insurtech companies and other industry players to leverage their expertise and technology.

- Invest in Talent: Attract and retain skilled professionals with expertise in technology, data analytics, and customer experience.

Corporate Social Responsibility

Harco National Insurance Company recognizes that its success is inextricably linked to the well-being of the communities it serves. The company is committed to fostering a sustainable future, promoting diversity and inclusion, and actively engaging in community initiatives.

Sustainability Initiatives

Harco National Insurance Company actively seeks to minimize its environmental impact through various initiatives. The company has implemented energy-efficient practices in its offices, reducing its carbon footprint. Harco National Insurance Company also encourages its employees to adopt sustainable practices in their daily lives, promoting eco-friendly transportation options and waste reduction.

Diversity and Inclusion

Harco National Insurance Company believes that diversity and inclusion are essential for fostering a thriving workplace and a more equitable society. The company has implemented programs to promote diversity at all levels, from recruitment and hiring to leadership development. These programs aim to attract and retain a diverse workforce, ensuring that employees from all backgrounds feel valued and respected.

Community Engagement

Harco National Insurance Company is dedicated to supporting the communities where its employees live and work. The company actively engages in community outreach programs, sponsoring local events and organizations that focus on education, healthcare, and social welfare. Harco National Insurance Company also encourages its employees to volunteer their time and skills to support community causes.

Key Competitors

Harco National Insurance Company operates within a highly competitive insurance market, facing numerous players vying for market share. Identifying and understanding the key competitors is crucial for Harco to effectively position itself and strategize for growth. This section profiles Harco’s primary competitors, compares their offerings, strengths, and weaknesses, and analyzes the competitive landscape and potential threats.

Competitor Profiles

The primary competitors for Harco National Insurance Company are other national insurance companies offering similar products and services. These competitors include:

- Company A: A well-established national insurer known for its comprehensive product portfolio and strong financial performance. Company A boasts a large customer base and extensive distribution network, leveraging its brand recognition and customer loyalty to maintain its market position.

- Company B: A rapidly growing insurer focusing on innovation and technology, offering digital-first solutions and personalized customer experiences. Company B’s agility and technological prowess enable it to attract younger demographics and cater to evolving customer needs.

- Company C: A regional insurer with a strong presence in specific geographic markets. Company C leverages its local expertise and customer relationships to compete effectively within its chosen territories.

Competitive Landscape and Potential Threats

The insurance industry is characterized by intense competition, driven by factors such as:

- Increased Price Transparency: Online platforms and comparison websites have empowered consumers with access to real-time price information, making it easier to compare offerings across different insurers. This increased price transparency has put pressure on insurers to remain competitive on pricing.

- Emerging Technologies: Insurtech companies are disrupting traditional insurance models by leveraging data analytics, artificial intelligence, and automation to offer innovative products and services. This technological disruption is forcing established players to adapt and invest in digital capabilities to stay relevant.

- Shifting Customer Expectations: Consumers are increasingly demanding personalized experiences, seamless digital interactions, and value-added services. Insurers that fail to meet these evolving expectations risk losing customers to competitors who offer more tailored and convenient solutions.

Competitive Analysis

To effectively compete in this dynamic landscape, Harco National Insurance Company must:

- Differentiate its offerings: Harco should focus on developing unique product features, value-added services, and customer-centric experiences that set it apart from its competitors. This could include tailored insurance packages, personalized risk assessments, or innovative claims management processes.

- Embrace digital transformation: Investing in technology and digital capabilities is crucial for Harco to enhance its customer experience, streamline operations, and stay ahead of the curve in the rapidly evolving insurance market. This includes developing user-friendly mobile apps, implementing data analytics to personalize offerings, and automating processes for efficiency.

- Strengthen its brand and customer relationships: Building a strong brand reputation and fostering long-term customer relationships are essential for Harco’s success. This can be achieved through effective marketing campaigns, personalized communication, and exceptional customer service.

Future Outlook and Growth Strategies

Harco National Insurance Company has a clear vision for its future, aiming to solidify its position as a leading provider in the evolving insurance landscape. The company’s growth strategy focuses on leveraging its strong financial foundation, innovative product offerings, and commitment to customer satisfaction to navigate emerging trends and capitalize on new opportunities.

Growth Plans and Objectives

Harco National Insurance Company’s long-term growth plans are anchored in a multi-pronged approach that encompasses expanding its market reach, enhancing its product and service portfolio, and embracing technological advancements. The company aims to achieve sustainable growth by:

- Expanding into new markets: Harco National Insurance Company plans to strategically expand its operations into new geographic markets, particularly those with a growing middle class and rising demand for insurance products. This expansion will involve establishing new partnerships, acquiring existing businesses, and leveraging its existing network to reach new customers. For example, the company could explore expanding into emerging markets such as Southeast Asia or Latin America, where the insurance penetration rate is still relatively low.

- Developing innovative products and services: The company is committed to developing innovative insurance products and services that cater to the evolving needs of its customers. This includes exploring new technologies such as artificial intelligence and blockchain to create personalized and seamless customer experiences. For instance, Harco National Insurance Company could develop AI-powered chatbots to provide instant customer support or offer personalized insurance plans based on individual risk profiles.

- Strengthening its digital capabilities: Harco National Insurance Company recognizes the importance of digital transformation in the insurance industry. The company is investing heavily in its digital infrastructure to improve its online presence, enhance its customer service channels, and develop new digital products and services. This could involve creating a user-friendly mobile app for policy management, claims filing, and customer support, or developing a comprehensive online platform for insurance comparison and purchase.

- Building strategic partnerships: Harco National Insurance Company is actively seeking strategic partnerships with other companies in the insurance and technology sectors. These partnerships will allow the company to access new markets, leverage complementary technologies, and expand its product offerings. For example, the company could partner with a fintech company to develop innovative payment solutions or collaborate with a technology provider to integrate AI-powered risk assessment tools.

- Investing in employee development: Harco National Insurance Company recognizes that its employees are its most valuable asset. The company is committed to investing in employee development through training programs, mentorship opportunities, and career advancement pathways. This will ensure that the company has a skilled and motivated workforce capable of driving its future growth.

Key Areas for Future Expansion and Innovation

Harco National Insurance Company identifies several key areas for future expansion and innovation, focusing on:

- Cybersecurity: As cyber threats continue to evolve, Harco National Insurance Company recognizes the need to develop comprehensive cybersecurity solutions for its customers. The company will invest in advanced cybersecurity technologies and develop specialized insurance products that cover cyber risks. This could involve offering cyber liability insurance, data breach response services, and security awareness training for businesses and individuals.

- Health and Wellness: The company is exploring opportunities to expand its offerings in the health and wellness space. This could involve developing health insurance plans that incorporate preventive care and wellness programs, or offering telemedicine services to provide convenient and affordable healthcare access.

- Sustainable Insurance: Harco National Insurance Company is committed to promoting sustainable practices and supporting the transition to a low-carbon economy. The company plans to develop insurance products that incentivize environmentally friendly behavior and support the development of renewable energy sources. This could involve offering discounts on insurance premiums for customers who install solar panels or purchase electric vehicles.

- Data Analytics and Artificial Intelligence: Harco National Insurance Company is leveraging data analytics and artificial intelligence to improve its underwriting processes, personalize customer experiences, and develop new products and services. This could involve using AI-powered risk assessment tools to determine premiums, developing personalized insurance recommendations based on customer data, or creating chatbots to provide instant customer support.

Regulatory Environment

The insurance industry operates within a complex regulatory framework designed to protect policyholders, ensure financial stability, and maintain market integrity. Harco National Insurance Company, like all insurers, is subject to a myriad of laws and regulations at both the federal and state levels.

Impact of Regulations on Harco National Insurance Company

Regulations significantly influence Harco National Insurance Company’s operations and strategies in several key areas:

- Product Development and Pricing: Regulations govern the types of insurance products that can be offered, the terms and conditions of policies, and the pricing methodologies used. For example, the Affordable Care Act (ACA) mandates certain coverage provisions for health insurance plans, while state-specific regulations may dictate rate filings and approval processes.

- Capital Requirements and Solvency: Regulators impose capital adequacy requirements to ensure insurers can meet their obligations to policyholders. These requirements, such as the risk-based capital (RBC) framework, influence Harco National’s investment strategies and risk management practices. Insurers must maintain sufficient capital reserves to absorb potential losses and maintain financial stability.

- Consumer Protection: Regulations protect consumers from unfair or deceptive insurance practices. Harco National must comply with laws related to disclosure requirements, advertising standards, and claims handling procedures. These regulations aim to ensure transparency and fairness in the insurance market.

- Data Privacy and Security: Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) govern how insurers collect, use, and protect sensitive customer data. Harco National must implement robust data security measures and comply with data privacy regulations to protect customer information.

Technology and Innovation

Harco National Insurance Company has recognized the transformative potential of technology and has made significant investments to modernize its operations. The company’s strategic focus on technology aims to enhance efficiency, improve customer experience, and drive innovation.

Technology Adoption and Use

Harco National Insurance Company leverages a range of technologies to streamline its processes and enhance its service offerings. These technologies include:

- Customer Relationship Management (CRM) Systems: These systems enable Harco National Insurance Company to manage customer interactions effectively, track customer preferences, and provide personalized services. This improves customer satisfaction and loyalty.

- Data Analytics and Business Intelligence: Harco National Insurance Company utilizes advanced data analytics tools to gain insights into customer behavior, market trends, and risk assessment. This data-driven approach allows the company to make informed decisions and optimize its operations.

- Cloud Computing: Harco National Insurance Company leverages cloud computing platforms to enhance scalability, flexibility, and cost-effectiveness. Cloud infrastructure allows the company to access computing resources on demand, enabling rapid deployment of new applications and services.

- Artificial Intelligence (AI): Harco National Insurance Company explores the use of AI in various areas, including fraud detection, risk assessment, and customer service. AI-powered chatbots can provide instant support to customers, while AI algorithms can analyze large datasets to identify potential risks and fraudulent activities.

Key Technology Trends Impacting the Insurance Industry

The insurance industry is undergoing a rapid technological transformation, driven by several key trends:

- Internet of Things (IoT): IoT devices are increasingly being used to collect data on risks and behaviors, enabling insurers to offer more personalized and tailored insurance products. For example, telematics devices in vehicles can track driving behavior, allowing insurers to offer discounts to safe drivers.

- Blockchain Technology: Blockchain has the potential to revolutionize insurance operations by enabling secure and transparent data sharing, reducing fraud, and streamlining claims processing. It can also facilitate the development of new insurance products and services, such as parametric insurance.

- Big Data and Analytics: The availability of vast amounts of data from various sources allows insurers to gain deeper insights into customer behavior, risk factors, and market trends. This data-driven approach enables insurers to develop more accurate pricing models, improve risk assessment, and personalize customer experiences.

- Mobile Technology: Mobile devices are becoming increasingly prevalent in the insurance industry, enabling customers to access insurance services and manage their policies on the go. Insurers are developing mobile apps to provide a seamless and convenient customer experience.

Innovation and Disruption

Harco National Insurance Company is actively investing in innovation to stay ahead of the competition and disrupt the market. The company’s innovation initiatives include:

- Developing New Products and Services: Harco National Insurance Company is exploring new insurance products and services that leverage technology to address emerging customer needs. For example, the company is developing parametric insurance products that provide payouts based on predefined events, such as extreme weather conditions.

- Partnering with Fintech Companies: Harco National Insurance Company is collaborating with fintech companies to leverage their expertise in technology and data analytics. These partnerships allow the company to access cutting-edge technologies and develop innovative solutions.

- Investing in Research and Development: Harco National Insurance Company is investing in research and development to explore new technologies and develop innovative solutions. This includes exploring the use of AI, blockchain, and other emerging technologies to enhance its operations and product offerings.

Outcome Summary

Harco National Insurance Company navigates the dynamic insurance landscape with a focus on innovation, customer-centricity, and a commitment to social responsibility. As the industry continues to evolve, Harco National Insurance Company is well-positioned to capitalize on emerging opportunities and maintain its leadership position, solidifying its reputation as a trusted and reliable provider of insurance solutions.