Texas, a state renowned for its expansive landscapes and robust economy, also boasts a dynamic insurance market. This dynamic landscape is driven by a confluence of factors, including a burgeoning population, a diverse range of industries, and the ever-present threat of natural disasters. From the bustling metropolises to the sprawling rural areas, the need for insurance protection permeates every corner of the Lone Star State.

This comprehensive guide delves into the intricacies of the Texas insurance market, exploring its size, key players, regulatory framework, and evolving trends. We examine the diverse types of insurance available, providing insights into coverage, benefits, and the costs associated with each. Additionally, we shed light on the claims process, consumer protection measures, and the impact of natural disasters on the insurance landscape.

Texas State Insurance Market Overview

The Texas insurance market is a significant player in the national landscape, characterized by its substantial size and robust growth. The state’s diverse economy, large population, and expanding commercial activity contribute to a thriving insurance sector.

Major Insurance Carriers in Texas

Several prominent insurance companies operate within the Texas market, contributing significantly to its overall size and scope.

- State Farm: A leading provider of property and casualty insurance, State Farm holds a dominant position in the Texas market, known for its extensive network and diverse product offerings.

- Allstate: Another major player in the property and casualty insurance segment, Allstate boasts a strong presence in Texas, offering a comprehensive range of insurance solutions to individuals and businesses.

- Farmers Insurance: A significant force in the Texas insurance market, Farmers Insurance provides a wide array of insurance products, including auto, home, and business coverage.

- USAA: Specializing in insurance and financial services for military personnel and their families, USAA has a substantial presence in Texas, catering to a significant segment of the population.

- Progressive: Known for its innovative approach to insurance, Progressive has established a strong foothold in the Texas market, offering competitive rates and flexible coverage options.

Factors Driving Insurance Demand in Texas

Several key factors contribute to the robust demand for insurance in Texas.

- Rapid Population Growth: Texas has experienced consistent population growth in recent years, leading to an increased demand for insurance products, including auto, home, and life insurance.

- Economic Expansion: Texas’s strong economy and diverse industries drive business growth, leading to a higher demand for commercial insurance, including property, liability, and workers’ compensation coverage.

- Natural Disasters: Texas is susceptible to various natural disasters, including hurricanes, tornadoes, and floods, making insurance a necessity for residents and businesses to mitigate potential financial losses.

- Rising Property Values: The increasing value of homes and businesses in Texas leads to a greater demand for insurance to cover potential losses from damage or destruction.

- Regulatory Environment: Texas’s regulatory framework fosters a competitive insurance market, encouraging innovation and providing consumers with a wider range of options.

Types of Insurance in Texas

Texas offers a wide range of insurance options to meet the diverse needs of its residents and businesses. Understanding the different types of insurance available is crucial for individuals and organizations to make informed decisions about protecting their assets and mitigating risks. This section provides a comprehensive overview of common insurance types in Texas, outlining their coverage and benefits, and offering examples of specific policies.

Property Insurance

Property insurance in Texas protects individuals and businesses against financial losses arising from damage to their property due to various perils, such as fire, theft, vandalism, and natural disasters.

- Homeowners Insurance: This type of insurance covers losses to a homeowner’s primary residence, including the dwelling itself, its contents, and liability for injuries or damages occurring on the property. For example, a homeowner’s policy would cover the cost of repairs if a fire damaged the house or if a guest sustained an injury on the property.

- Renters Insurance: Renters insurance protects renters against losses to their personal belongings and liability for damages to the rental property. For instance, if a renter’s belongings were damaged in a fire or stolen, renters insurance would cover the cost of replacement.

- Commercial Property Insurance: This insurance protects businesses against losses to their commercial buildings, inventory, equipment, and other assets. For example, a commercial property policy would cover the cost of rebuilding a business after a fire or the replacement of stolen inventory.

Liability Insurance

Liability insurance in Texas provides financial protection to individuals and businesses against legal claims arising from injuries or damages caused to others.

- Personal Liability Insurance: This type of insurance protects individuals against claims arising from their personal actions. For example, if someone were to be injured on an individual’s property, personal liability insurance would cover the cost of legal defense and any settlements or judgments.

- Commercial Liability Insurance: This insurance protects businesses against claims arising from their business operations. For example, if a customer were to be injured on a business’s premises, commercial liability insurance would cover the cost of legal defense and any settlements or judgments.

- Umbrella Insurance: This type of insurance provides additional liability coverage beyond the limits of other policies. For example, if someone were to be sued for a large amount of money, umbrella insurance would provide additional coverage to protect their assets.

Auto Insurance

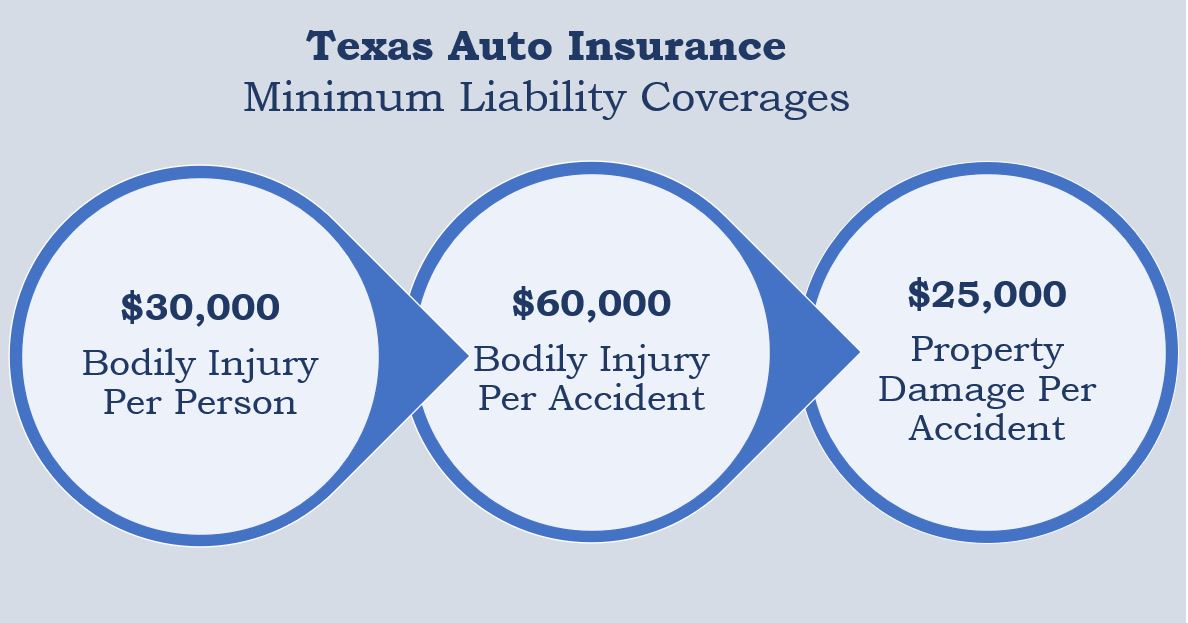

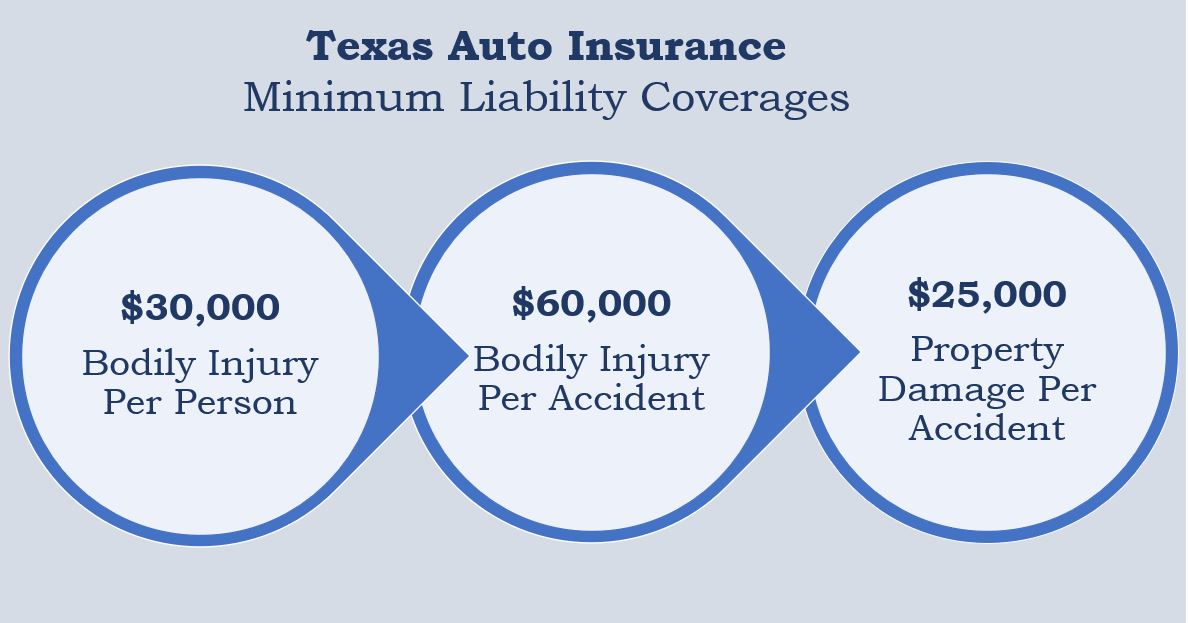

Auto insurance in Texas is mandatory and provides financial protection to individuals and businesses against losses arising from accidents involving their vehicles.

- Liability Coverage: This type of insurance covers damages to other vehicles or property and injuries to other people in an accident caused by the insured.

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for damages to the insured vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured in case of an accident with a driver who is uninsured or underinsured.

Health Insurance

Health insurance in Texas provides financial protection against the costs of medical care.

- Individual Health Insurance: This type of insurance is purchased by individuals and families directly from insurance companies.

- Employer-Sponsored Health Insurance: This type of insurance is provided by employers to their employees.

- Medicare: This federal health insurance program is available to individuals aged 65 and older, as well as individuals with certain disabilities.

- Medicaid: This state-funded health insurance program is available to low-income individuals and families.

Life Insurance

Life insurance in Texas provides financial protection to beneficiaries in the event of the insured’s death.

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years.

- Permanent Life Insurance: This type of insurance provides lifelong coverage and includes a cash value component that grows over time.

Other Types of Insurance

In addition to the insurance types listed above, Texas also offers various other types of insurance, including:

- Workers’ Compensation Insurance: This type of insurance protects employees against injuries or illnesses sustained while on the job.

- Disability Insurance: This type of insurance provides financial protection to individuals who are unable to work due to an illness or injury.

- Flood Insurance: This type of insurance protects individuals and businesses against losses due to flooding.

- Earthquake Insurance: This type of insurance protects individuals and businesses against losses due to earthquakes.

- Business Interruption Insurance: This type of insurance protects businesses against losses due to interruptions in their operations, such as from a fire or natural disaster.

Texas Insurance Regulations and Laws

Texas has a complex and comprehensive regulatory framework for the insurance industry. The state’s insurance laws and regulations aim to protect consumers, ensure the solvency of insurance companies, and promote fair competition in the marketplace.

Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) is the primary regulatory body for the insurance industry in the state. It is responsible for licensing insurance companies, agents, and brokers; overseeing the financial solvency of insurers; enforcing insurance laws and regulations; and resolving consumer complaints. The TDI also plays a role in educating consumers about insurance products and their rights.

Key Insurance Regulations and Laws in Texas

Texas has a wide range of insurance regulations and laws covering various aspects of the industry. Some of the key regulations include:

- Texas Insurance Code: This code provides the legal framework for the regulation of insurance in the state. It covers topics such as licensing, rates, claims, and consumer protection.

- Texas Administrative Code: This code contains rules and regulations adopted by the TDI to implement the provisions of the Texas Insurance Code.

- Consumer Protection Laws: Texas has several laws designed to protect consumers in the insurance marketplace. These laws include the Texas Deceptive Trade Practices Act (DTPA), which allows consumers to sue insurance companies for deceptive or unfair business practices.

- Financial Solvency Regulations: The TDI has stringent regulations in place to ensure the financial solvency of insurance companies operating in Texas. These regulations include requirements for capital adequacy, risk management, and financial reporting.

Implications of Texas Insurance Regulations for Consumers and Insurers

The Texas insurance regulatory framework has significant implications for both consumers and insurers.

Implications for Consumers

- Consumer Protection: Texas insurance regulations provide consumers with numerous protections, such as the right to file complaints with the TDI, the right to access information about insurance products, and the right to be treated fairly by insurance companies.

- Access to Insurance: The TDI works to ensure that consumers have access to affordable and adequate insurance coverage. This includes promoting competition in the insurance market and ensuring that insurers offer a variety of products to meet the needs of different consumers.

- Fair Claims Handling: Texas insurance regulations require insurers to handle claims fairly and promptly. Consumers have the right to appeal claims decisions and to seek assistance from the TDI if they believe their claims have been handled unfairly.

Implications for Insurers

- Compliance Requirements: Insurers operating in Texas must comply with a wide range of regulations, including those related to licensing, rates, claims, and financial solvency. Non-compliance can result in fines, penalties, and even the loss of their license to operate in the state.

- Market Stability: The TDI’s regulations are designed to promote stability in the insurance market. This includes ensuring that insurers have adequate capital to cover their obligations and that they engage in sound risk management practices.

- Consumer Trust: By enforcing fair and ethical business practices, the TDI helps to build consumer trust in the insurance industry. This is essential for the long-term health and sustainability of the insurance market in Texas.

Insurance Costs in Texas

Insurance premiums in Texas, like in any other state, are influenced by a variety of factors. These factors can significantly impact the cost of insurance for individuals and businesses. Understanding these factors can help consumers make informed decisions about their insurance coverage and potentially save money.

Factors Influencing Insurance Premiums in Texas

Several factors play a role in determining insurance premiums in Texas. These include:

- Location: Insurance premiums are often higher in areas with a higher risk of natural disasters, such as hurricanes or tornadoes. Texas, with its extensive coastline and susceptibility to severe weather, can experience variations in premiums based on location. For example, coastal areas with a higher risk of hurricane damage may see higher premiums than inland areas.

- Type of Coverage: The type of insurance coverage chosen significantly impacts the premium. Comprehensive coverage, which covers a broader range of risks, typically comes with a higher premium than basic liability coverage. For example, adding collision coverage to your auto insurance policy will increase your premium, but it will also provide financial protection in case of an accident.

- Driving History: For auto insurance, driving history is a major factor. Drivers with a history of accidents, traffic violations, or DUI convictions will generally face higher premiums. This is because insurers view these drivers as posing a higher risk of future claims.

- Age and Gender: Age and gender can also influence insurance premiums. Younger drivers, especially those under 25, tend to pay higher premiums due to their higher risk of accidents. Gender can also play a role, as statistics have shown that men, on average, have a higher risk of accidents than women.

- Credit Score: Surprisingly, credit score can be a factor in determining insurance premiums in some states, including Texas. This is because a good credit score is often associated with responsible behavior, which insurers see as a positive indicator. Individuals with lower credit scores may face higher premiums.

- Vehicle Type: For auto insurance, the type of vehicle you drive impacts the premium. Luxury cars, sports cars, and vehicles with high safety ratings often have higher premiums. This is due to their higher repair costs and increased likelihood of theft.

Comparison of Insurance Costs in Texas to Other States

Texas insurance costs can be compared to other states to understand the overall landscape. According to the National Association of Insurance Commissioners (NAIC), Texas ranks in the middle range for average auto insurance premiums. However, it’s important to note that premiums can vary significantly within the state, depending on the factors mentioned above.

Texas is known for its competitive insurance market, with numerous insurance companies vying for customers. This competition can lead to lower premiums for consumers, especially when comparing rates from different insurers.

Tips for Finding Affordable Insurance in Texas

Finding affordable insurance in Texas requires some effort and research. Here are some tips:

- Shop Around: Get quotes from multiple insurance companies. Don’t just rely on your current insurer. Use online comparison websites or work with an independent insurance agent who can compare quotes from multiple insurers.

- Bundle Policies: Combining multiple insurance policies, such as auto and homeowners insurance, with the same insurer can often result in discounts. This bundling can lead to significant savings.

- Consider Increasing Deductibles: A higher deductible means you pay more out of pocket in case of a claim. However, it can also lead to lower premiums. Consider your financial situation and risk tolerance when deciding on a deductible amount.

- Maintain a Good Driving Record: This is crucial for keeping auto insurance premiums low. Avoid accidents, traffic violations, and driving under the influence.

- Improve Your Credit Score: If your credit score is a factor in your insurance premiums, consider taking steps to improve it. This can lead to lower premiums over time.

- Ask About Discounts: Many insurers offer discounts for various factors, such as good student discounts, safe driver discounts, and discounts for installing safety features in your car. Inquire about available discounts to see if you qualify.

Insurance Claims Process in Texas

Filing an insurance claim in Texas can be a complex process, but understanding the steps involved and common challenges can help claimants navigate it effectively. This section will Artikel the general steps involved in filing a claim, discuss common challenges, and provide tips for a smooth claims process.

Steps Involved in Filing an Insurance Claim

The claims process in Texas typically involves the following steps:

- Report the Claim: Immediately contact your insurance company to report the claim. This should be done as soon as possible after the incident occurs, as this is the first step in initiating the claims process. You will need to provide details about the incident, including the date, time, location, and any other relevant information.

- File a Claim: After reporting the claim, you will need to file a formal claim with your insurance company. This typically involves completing a claim form and providing supporting documentation, such as police reports, medical bills, and repair estimates.

- Investigation: Once the claim is filed, your insurance company will begin an investigation to verify the details of the claim. This may involve inspecting the damage, interviewing witnesses, and reviewing supporting documentation.

- Negotiation: After the investigation, your insurance company will assess the claim and determine the amount of coverage. This process may involve negotiation with you to reach a mutually agreeable settlement.

- Payment: If the claim is approved, your insurance company will issue a payment for the covered losses. The payment may be made directly to you or to a third party, such as a repair shop.

Common Challenges Faced by Claimants

Claimants in Texas often face various challenges during the claims process, including:

- Unclear Policy Coverage: One common challenge is understanding the extent of coverage provided by their insurance policy. This can lead to disputes over what is covered and what is not.

- Delayed Payments: Claimants may experience delays in receiving payments, which can cause financial hardship. Delays can arise due to various factors, such as complex investigations, disputes over coverage, or administrative backlogs.

- Communication Issues: Communication issues between the claimant and the insurance company can also be challenging. This may involve difficulty reaching a representative, lack of timely updates, or misunderstandings regarding the claims process.

- Denial of Claims: Insurance companies may deny claims based on various reasons, such as lack of coverage, policy exclusions, or failure to meet the terms of the policy.

- Low Settlement Offers: Insurance companies may offer low settlement amounts, which may not adequately cover the losses incurred by the claimant.

Tips for Navigating the Claims Process Effectively

To navigate the claims process in Texas effectively, claimants can consider the following tips:

- Review Your Policy: Carefully review your insurance policy to understand the coverage, exclusions, and limitations. This will help you avoid surprises and disputes during the claims process.

- Document Everything: Maintain thorough documentation of the incident, including dates, times, locations, and any other relevant details. Keep copies of all correspondence, invoices, and supporting documentation.

- Be Prompt and Cooperative: Respond to your insurance company’s requests for information promptly and cooperate fully with their investigation. This will help expedite the claims process.

- Communicate Clearly: Maintain clear and open communication with your insurance company. If you have questions or concerns, express them clearly and seek clarification.

- Consider Legal Counsel: If you face difficulties in the claims process, consider seeking legal counsel from an experienced insurance lawyer. A lawyer can help you understand your rights, negotiate with the insurance company, and pursue legal action if necessary.

Consumer Protection in Texas Insurance

Texas has robust consumer protection laws and regulations in place to ensure fair and transparent insurance practices. These laws aim to safeguard policyholders’ rights and address potential issues that may arise during the insurance process.

Consumer Rights and Responsibilities

Texas law grants insurance consumers specific rights, including the right to:

- Receive clear and concise insurance policies that are easy to understand.

- Be treated fairly and honestly by insurance companies.

- File complaints with the Texas Department of Insurance (TDI) if they believe their rights have been violated.

- Access information about their insurance policies, including coverage details, premiums, and claim procedures.

- Cancel their insurance policies within a specific timeframe and receive a refund of unused premiums.

Consumers also have responsibilities, such as:

- Providing accurate information to insurance companies when applying for coverage.

- Paying premiums on time to maintain coverage.

- Notifying their insurance company of any changes in their circumstances that may affect their coverage.

- Cooperating with insurance companies during the claims process.

Resolving Insurance Disputes in Texas

If an insurance consumer has a dispute with their insurance company, they can explore several options for resolution:

- Contact the Texas Department of Insurance (TDI): The TDI is the primary regulatory body for insurance in Texas and offers resources and assistance to consumers. They can investigate complaints, mediate disputes, and enforce insurance laws.

- Mediation: Mediation is a process where a neutral third party helps both parties reach a mutually acceptable agreement. The TDI offers mediation services to resolve insurance disputes.

- Arbitration: Arbitration is a formal process where a neutral third party hears both sides of the dispute and makes a binding decision. Some insurance policies may require arbitration for specific types of disputes.

- Litigation: If all other options fail, consumers can file a lawsuit in court to resolve their insurance dispute.

“The Texas Department of Insurance (TDI) is committed to protecting consumers and ensuring a fair and competitive insurance market.” – TDI website

Insurance Industry Trends in Texas

The Texas insurance market is a dynamic and evolving landscape, shaped by a confluence of factors including technological advancements, regulatory changes, and shifting consumer preferences. Understanding these trends is crucial for both insurers and consumers, as it informs strategic decisions and guides expectations for the future.

Impact of Technology on the Texas Insurance Industry

Technology is fundamentally reshaping the Texas insurance industry, driving innovation and efficiency across various aspects of the business. From underwriting and claims processing to customer engagement and distribution, technology is transforming the way insurers operate and interact with their clients.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being deployed to automate tasks, improve underwriting accuracy, detect fraud, and personalize customer experiences. For example, AI-powered chatbots are being used to handle routine inquiries and provide 24/7 customer support. AI algorithms can analyze vast amounts of data to assess risk and determine appropriate premiums, streamlining the underwriting process and potentially reducing costs.

- Internet of Things (IoT): Connected devices are generating a wealth of data that can be used to monitor risks and optimize insurance policies. For instance, telematics devices in vehicles can track driving behavior, providing insurers with insights into risk profiles and enabling them to offer usage-based insurance premiums. Smart home devices can detect potential hazards, such as water leaks or fire, enabling insurers to respond quickly and minimize damages.

- Blockchain Technology: Blockchain’s immutability and transparency can enhance the efficiency and security of insurance processes. It can facilitate faster and more secure claims processing, improve data management, and reduce the risk of fraud. Furthermore, blockchain can enable the creation of new insurance products, such as parametric insurance, which automatically triggers payouts based on predefined events.

Texas Insurance Industry Associations

Texas is home to a robust insurance industry, with numerous associations playing vital roles in supporting, advocating for, and shaping the sector. These associations provide a platform for industry professionals to network, share best practices, and influence policy decisions.

Key Insurance Industry Associations in Texas

The following associations are prominent players in the Texas insurance landscape:

- Texas Department of Insurance (TDI): The TDI is the primary regulatory body for the insurance industry in Texas. It oversees insurance companies, agents, and brokers, ensuring compliance with state laws and protecting consumers.

- Texas Association of Insurance Agents (TAIA): The TAIA represents independent insurance agents in Texas, advocating for their interests and providing resources for professional development.

- Independent Insurance Agents & Brokers of Texas (IIABTX): IIABTX is another influential association representing independent insurance agents and brokers, promoting professionalism and advocating for sound insurance regulations.

- Texas Association of Mutual Insurance Companies (TAMIC): TAMIC represents mutual insurance companies in Texas, which are owned by their policyholders. It focuses on promoting the interests of these companies and supporting their operations.

- Texas Insurance Council (TIC): The TIC is a broad-based association representing various segments of the insurance industry in Texas, including insurers, agents, and brokers. It advocates for sound insurance policies and promotes the industry’s role in the state’s economy.

Role of Associations in Supporting the Industry

Texas insurance industry associations play a crucial role in supporting the industry through various activities:

- Advocacy: Associations represent the interests of their members before state and federal policymakers, advocating for legislation and regulations that support the industry. They also engage in public relations efforts to educate the public about the importance of insurance.

- Education and Training: Associations provide professional development opportunities for their members, offering courses, seminars, and conferences on insurance-related topics. This helps enhance the knowledge and skills of insurance professionals.

- Networking: Associations provide platforms for industry professionals to connect with each other, share best practices, and build relationships. These networks are essential for fostering collaboration and innovation within the industry.

- Research and Analysis: Some associations conduct research and analysis on industry trends and issues, providing valuable insights to their members and policymakers. This helps inform decision-making and ensure the industry remains adaptable to changing market conditions.

Influence on Insurance Policies and Regulations

Texas insurance industry associations exert significant influence on insurance policies and regulations through their advocacy efforts.

- Lobbying: Associations actively lobby state lawmakers and regulators, advocating for policies that benefit their members. They may support or oppose specific bills, regulations, or amendments related to insurance.

- Public Awareness Campaigns: Associations may conduct public awareness campaigns to educate consumers about insurance and promote the importance of insurance coverage. They may also advocate for specific consumer protections within insurance policies.

- Expert Testimony: Associations may provide expert testimony at legislative hearings and regulatory proceedings, sharing their knowledge and perspectives on insurance issues. This helps shape policy decisions and ensure they are informed by industry expertise.

- Collaboration with Regulators: Associations may collaborate with state regulators to develop and implement policies that promote a healthy and stable insurance market. This collaborative approach ensures that regulations are practical and effective for both the industry and consumers.

Impact of Natural Disasters on Texas Insurance

Texas is a state prone to natural disasters, particularly hurricanes and floods. These events can have a significant impact on the state’s insurance industry, affecting both insurers and policyholders.

The Role of Insurance in Disaster Recovery

Insurance plays a crucial role in disaster recovery by providing financial assistance to policyholders who have suffered losses. This assistance can help individuals and businesses rebuild their lives and properties after a natural disaster. For example, homeowners insurance can cover damage to a home caused by a hurricane, while flood insurance can cover damage to a home caused by flooding.

Closure

Understanding the intricacies of the Texas insurance market is crucial for both individuals and businesses. By navigating the complex landscape of regulations, costs, and claims processes, Texans can make informed decisions to secure the appropriate coverage for their unique needs. As the state continues to grow and evolve, the insurance industry will undoubtedly play a pivotal role in mitigating risk and fostering economic stability.